Part 2 of 2 Parts (Please read Part 1 first)

Globally, decommissioning costs for nuclear power plants range from one billion to one and a half billion dollars per one gigawatt plant. The cost of dismantling nuclear facilities associated with the fuel cycle, research reactors, and nuclear laboratories also needs consideration.

Furthermore, environmental challenges emerge when it is planned to either restore decommissioned nuclear sites to their original state or prepare them for future use. There is a considerable risk of the release of harmful nuclear materials and other pollutants in the event of any minor accidents. The ecological response must be assessed carefully and balanced with the imperative to maintain the site’s functionality and manage risk. These risks include the possibility of catastrophic collapse.

Recently there has been a great deal of progress on robotic technologies and artificial intelligence. Experts are increasingly focused on extending the autonomous operations of robots into more intricate yet harsh environments. There was a recent article in the journal Robotics that discussed special robots which are now being developed to perform complex tasks during nuclear decommissioning.

Handling objects in nuclear environments poses two primary challenges. One is dealing with unknown objects and ensuring their safe manipulation without breaking or dropping them. Haptic intelligence and leveraging tactile sense in contemporary robotics have enhanced the safety of grasping before and during object manipulation.

Recently, a novel approach employing fiber-optic tactile sensors for detecting surface cracks has been developed. This technique offers distinct advantages, designed with nuclear decommissioning in mind. It is intended for use with remotely operated robots. Fiber optics is advantageous because it is not affected by gamma radiation. This provides a potential alternative to electrical cables for nuclear power plant applications.

C-Tech is a company registered in the U.K. It has been carrying out research studies for the past ten years to develop an innovative electrochemical nuclear decontamination system that is much less expensive the current methods.

The first technological innovation announced by the company was its advanced electrolytically assisted surface decontamination (EASD) system. This technology offers controlled, rapid, and cost-effective methods for dissolving surfaces with the use of nitric acid as the medium.

This technology facilitates the removal of radioactivity from contaminated metal by leveraging accelerated electrolytic dissolution of the contaminated metal surface. The resulting radioactive dissolved metal is transferred into the nitric acid effluent. The result of this technique is processed downstream using conventional methods.

Electrochemical Nuclear Decontamination (ELENDES) technology is poised to revolutionize the removal of contaminated organic matter from the aqueous effluent before downstream processing.

ELENDES consists of electrochemically oxidating insoluble organic waste materials at nuclear sites. This effectively eliminates the organic matter that contains radioactive content from the waste material. This advanced electrochemical nuclear decontamination solution provides a safe and efficient means of removing contaminated organic from nuclear waste.

Several challenges still face the process of nuclear decommissioning. The complex planning and safe execution of this process is a major hurdle. The recent technological advancements in robotics and industrial equipment ensure that nuclear decommissioning will become safer and less expensive as time progresses.

Blog

-

Nuclear Reactors 1329 – Challenges Of Decommissioning Nuclear Power Plants – Part 2 of 2 Parts

-

Nuclear News Roundup December 21, 2023

BRIN to pursue two nuclear projects in 2024 en.antaranews.com

North Korea’s new reactor at nuclear site likely to be formally operational next summer, Seoul says timesenews.net

Nuclear energy has bright future, local business leader says jhnewsandguide.com

Tokyo High Court holds Japan government not liable for Fukushima nuclear disaster jurist.org

-

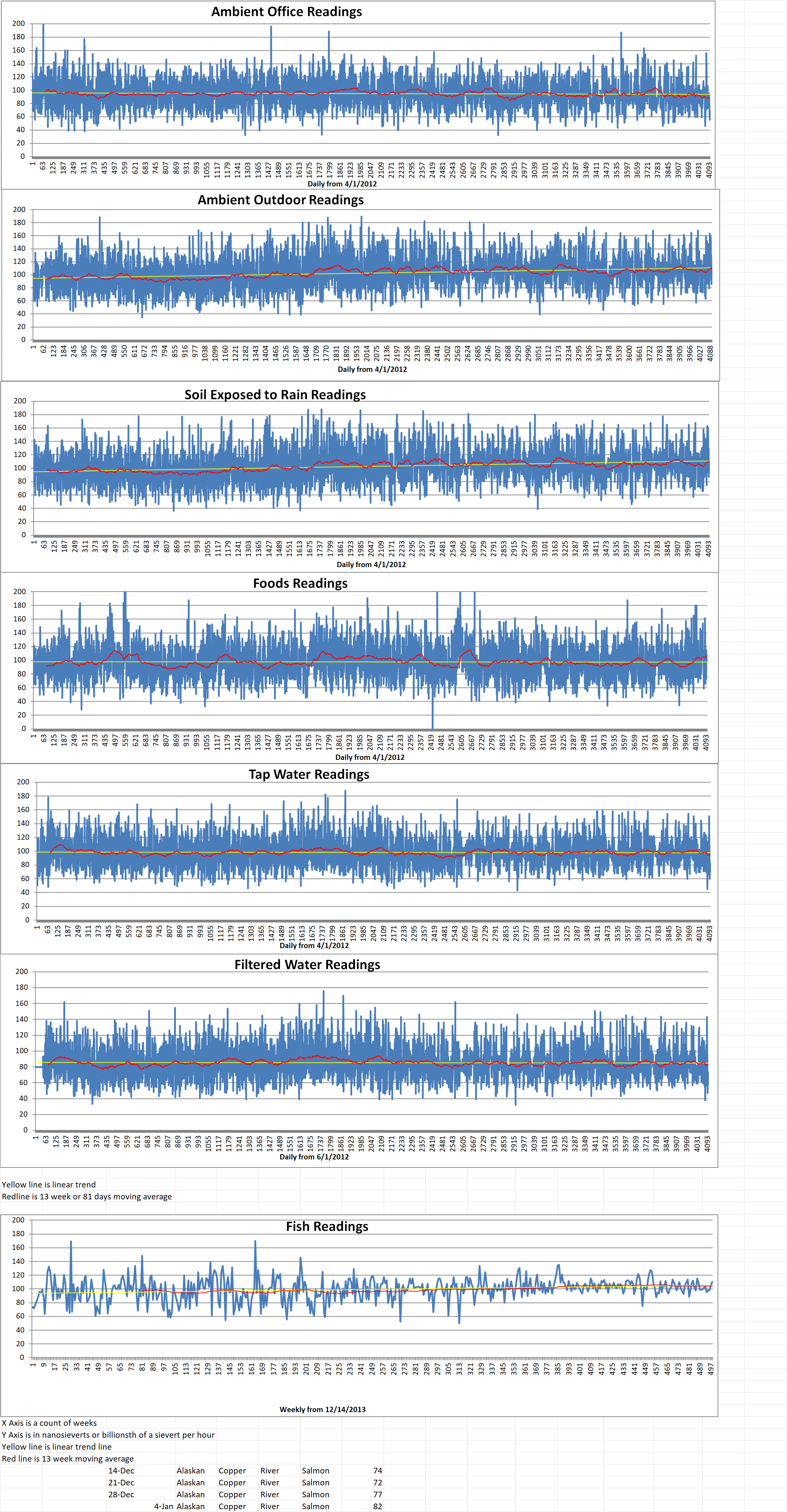

Geiger Readings for October December 21, 2023

Ambient office = 69 nanosieverts per hour

Ambient outside = 111 nanosieverts per hour

Soil exposed to rain water = 110 nanosieverts per hour

Red bell pepper from Central Market = 103 nanosieverts per hour

Tap water = 82 nanosieverts per hour

Filter water = 73 nanosieverts per hour

-

Nuclear Reactors 1328 – Challenges Of Decommissioning Nuclear Power Plants – Part 1 of 2 Parts

Part 1 of 2 Parts

Nuclear power plants generate electricity in some countries. Operational restrictions mandate that a nuclear power plant’s life is about thirty-five to forty-five years. At the end of their life cycle, nuclear power plants are decommissioned. Decommissioning is a very complex process that requires years, if not decades, of planning and execution.

The International Atomic Energy Agency (IAEA) defines the process of nuclear decommissioning as the combination of two operational tasks that must be performed simultaneously. These consist of administrative and technical activities. As a result of these activities, radioactive resources and waste generated by the operation of the plant must be thoroughly cleaned up. This is done in order for the plant site to be repurposed so it can be used for other purposes.

The first part of the complete process of nuclear decommissioning involves meticulous planning for ceasing operations, the radiological characterization of materials by experts, and the development of an efficient decontamination strategy for the nuclear site. The second part of the process is the safe dismantling of the facility structures, and the management of waste materials as dictated by rules and regulations. This comprehensive approach ensures the safe, efficient, and effective transition of the land under the plant for other uses in the future.

In the field of nuclear sciences, the safe decommissioning of facilities is considered an essential part of the whole life cycle management of nuclear power sites. Field experts are hired to devise relevant strategies for the closing and cleanup of nuclear sites.

The complex nuclear decommissioning process incorporates years of data gathering. The plan for the nuclear decommissioning of any facility is initiated along with the operational authorization of the facility. The plan must be economically and functionally viable. It must cover all associated financial costs. This early planning ensures that the nuclear waste is managed safely without causing any harm to the environment.

A detailed decommissioning plan is created upon final shutdown, outlining the strategy for safely dismantling the nuclear facility. It describes the steps required to ensure radiation protection for workers and the public, addresses significant environmental impacts, outlines the proper management of radioactive and non-radioactive materials, and details the termination process for regulatory authorization regarding the nuclear facility and its site.

Various technical, environmental, and social challenges threatened the decommissioning of existing nuclear power facilities and future energy infrastructure. It is critical to understand these challenges and devise sustainable solutions.

A research article recently published in the journal Energy Policy has highlighted several important challenges faced during the decommissioning of nuclear facilities. The statistics indicate that after mid-2020, only three percent of nuclear reactors have been fully decommissioned.

Decommissioning existing nuclear energy infrastructure faces technical challenges in safely managing radioactive, toxic, and hazardous materials. Correct handling, transportation, reusing, recycling, and disposing of standardized recycling policies and regulations for end-of-life waste management increases these challenges.

The economic implications of nuclear decommissioning are expected to be substantial and will increase as more nuclear facilities reach the end of their licensed life. Public funds often finance most nuclear decommissioning in Europe. Inadequate reserves by nuclear power plant operators means that taxpayers will probably bear the future decommissioning costs.

Please read Part 2 next -

Nuclear News Roundup December 20, 2023

Work begins to dismantle Garigliano reactor vessel world-nuclear-news.org

Belarus ‘could be a world leader in nuclear energy share’ world-nuclear-news.org

The Air Force said its nuclear missile capsules were safe. But toxins lurked, documents show norfolkneradio.com

Boris Johnson tells Sunak to ‘get on’ with slow nuclear power build independent.co.uk

-

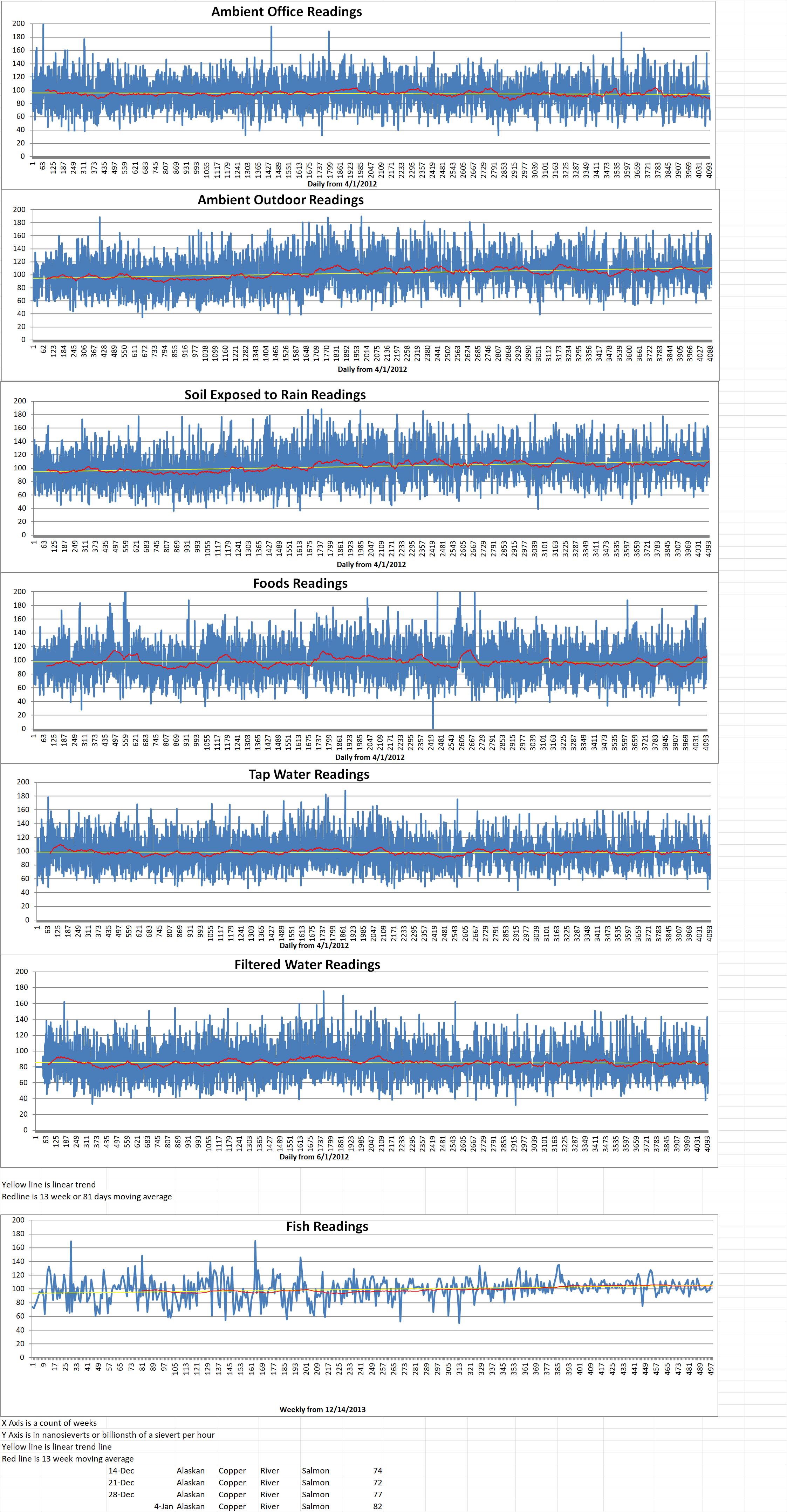

Geiger Readings for December 20, 2023

Ambient office = 55 nanosieverts per hour

Ambient outside = 106 nanosieverts per hour

Soil exposed to rain water = 107 nanosieverts per hour

Pinapple from Central Market = 97 nanosieverts per hour

Tap water = 72 nanosieverts per hour

Filter water = 63 nanosieverts per hour

-

Nuclear Reactors 1326 – Nuclear Start-ups Encounter Serious Problems – Part 2 of 2 Parts

Part 2 of 2 Parts (Please read Part 1 first)

Jacob DeWitte is the CEO of Oklo. He said, “There is a lot of value in staying small because it keeps the project in the scope of a manufacturing and installation project, and not a large infrastructure project.”

Oklo intends to construct its reactors for under sixty million dollars each. This is a fraction of the cost of the bigger utility scale projects that make-up the existing U.S. reactor fleet. Oklo reactors can be located near industrial customers’ facilities and use factory produced designs. This should dramatically reduce costs.

Cost increases and schedule delays have blighted large-scale nuclear projects in recent decades. This has made investors wary of the nuclear sector. Georgia Power’s Vogtle Plant faced seven years of delays and a seventeen-billion-dollar cost overrun before the first of its two new reactors began operations this year.

Vogtle deployed Westinghouse’s new AP1000 reactor design. It was the first reactor that the U.S. has built from scratch in more than three decades. The problems that it encountered “reinforced the reputation for negative construction experiences in the U.S.” This was covered in a report published last Thursday by Columbia University titled Uncertain Costs of New Nuclear Reactors.

Oklo enjoyed initial success when it attracted funding from the U.S. government and fuel from Idaho National Laboratory for its first plant in the state. It hopes that the new plant will start operations in 2027. However, like many of the new generation of nuclear start-up, Oklo has experience serious challenges as it tries to prove its technology to regulators and raise funds.

Last year, the Nuclear Regulatory Commission (NRC) denied Oklo’s application to build and operate its Idaho project. The NRC said that Oklo did not provide enough information on its reactor design.

DeWitte told the Financial Times that the company’s application process was delayed by the pandemic. Oklo is engaging with the NRC and expects to file a new application next year.

Adam Stein is the director of nuclear energy innovation at the Breakthrough Institute which is a Washington-based think tank. He said that the existing regulations were not designed to be flexible because they focused on the existing fleet of reactors which are typically big one-gigawatt water-cooled reactors.

He added that, “New applicants have to ask for exemptions from specific regulations that are not applicable to their technology, justify why those exemptions are reasonable and hope that the regulator grants them . . . [this] makes it more lengthy, cumbersome and introduces additional regulatory risk.”

The regulatory challenges come despite strong bipartisan support in the U.S. Congress for the nuclear industry.

The Biden administration recently asked Congress to provide two billion dollars to support the U.S.-based companies who are trying to boost enrichment and conversion capacity for nuclear fuel. It has also ensured that nuclear projects are eligible for a thirty percent tax credit which is detailed in the Inflation Reduction act for zero carbon power plants.

Kathryn Huff is the assistant secretary for nuclear energy. She told the Financial Times that progress has been made but she admitted that the sector must overcome these near-term challenges if the U.S. and others are to meet their 2050 emissions reduction goals. At least five to ten new contracts for new nuclear reactors would need to be finalized in the next few years to enable construction to be completed by 2035.

Huff added that “There are dozens of American nuclear reactor start-ups, which is just a crazy thing that you wouldn’t have heard 20 years ago when nuclear reactors were the bread and butter of big Fortune 500 engineering firms. [But] in the next two or three years, we need to see those contracts in hand, or else we will not reach the commercial lift-off that is required to get to the amount of clean power we need for 2050.” -

Nuclear News Roundup December 19, 2023

Russia says fire has been put out on nuclear-powered cargo ship reuters.com

North Korea’s Kim Jong Un orders military and nuclear weapons forces to ramp up war preparations news.sky.com

US, France, Germany and UK call on Iran to de-escalate nuclear program jpost.com

Ukraine war: How worried should we be about the Zaporizhzhia nuclear power plant? News.sky.com

-

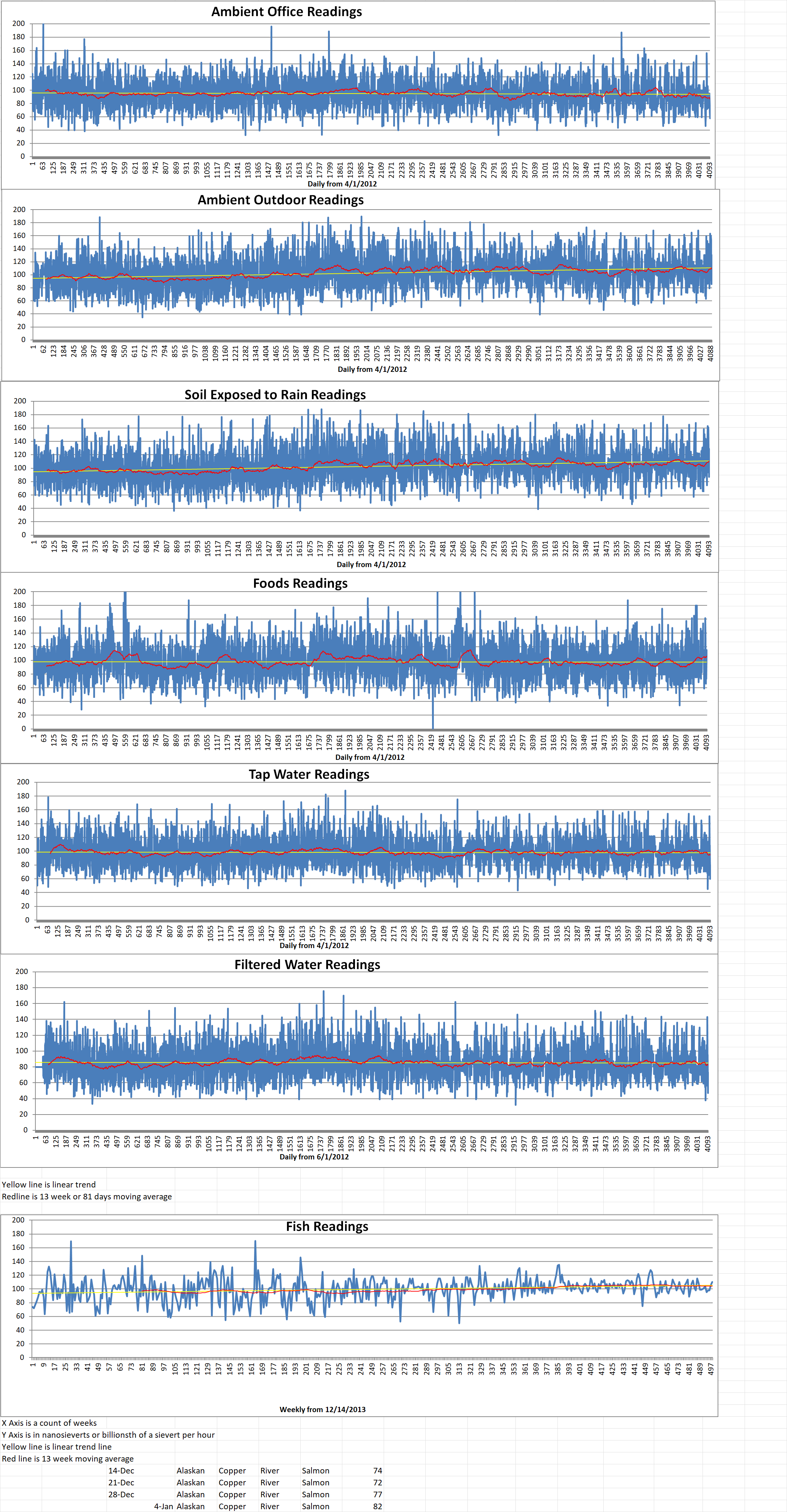

Geiger Readings for December 19, 2023

Ambient office = 58 nanosieverts per hour

Ambient outside = 100 nanosieverts per hour

Soil exposed to rain water = 104 nanosieverts per hour

Green onion from Central Market = 108 nanosieverts per hour

Tap water = 70 nanosieverts per hour

Filter water = 58 nanosieverts per hour

-

Nuclear Reactors 1325 – Nuclear Start-ups Encounter Serious Problems – Part 1 of 2 Parts

Part 1 of 2 Parts

The U.S. plans to expand its nuclear industry face big funding and regulatory challenges. These problems could delay a new generation of smaller, more efficient reactors supported by advocates as critical to fighting climate change. A sharp fall in market support for start-ups developing small modular reactors (SMRs) and other advanced nuclear facilities threaten U.S. ambitions.

Last month NuScale Power Corporation abandoned plans to construct the first SMR in the U.S., despite receiving one and a half billion dollars in government cost-sharing pledges. They were not able to find enough power utilities who were interested in purchasing electricity from their facility in Idaho. Estimated power prices rose by over fifty percent in two years to eighty-nine dollars per megawatt hour.

Prior to NuScale problems, a one billion eight hundred million deal between X-energy and special purpose acquisition company (SPAC) Ares Acquisition. The deal was intended to enable the developer of nuclear technologies to go public.

Currently, the nuclear industry is waiting to find out whether Oklo, a nuclear start-up, can successfully go public via a blank-check company announced in July with AltC Acquisitions Corporation. The merger was proposed at a valuation of eight hundred and fifty million dollars. This would provide Oklo with five hundred million dollars to develop and commercialize its reactor design.

Marc Bianchi is an analyst at Cowen. He said, “There was already some investor aversion surrounding Spacs in general, and then you saw the first SMR cancelled, inflation causing a big increase in costs and X-energy’s deal fall through. So investors are certainly more skeptical. This would seem to raise the bar for future transactions.”

The nuclear industry is racing to design and develop SMRs which are advanced nuclear reactors that have a power capacity of three hundred megawatts or less. Conventional nuclear power reactors have three or more times the capacity. Government and private investors have spent billions of dollars to commercialize the technology in the past decade.

However, a combination of rising interest rates, inflation and concerns about the nuclear industry’s poor record of delivering projects on time and on budget have soured investor and customer sentiment towards the small but growing cluster of start-ups and other companies in the sector.

Shares in NuScale, which listed last year, lost almost a third of their value following the cancellation of its Idaho project. The shares are down by seventy percent this year. The problems at NuScale are spreading across the SMR sector.

X-energy is backed by chemical giant Dow. It was forced to lay off staff last month following its failure to conclude its merger. And the U.S. Defense Logistics Agency recently confirmed it had rescinded a notice of intent to award a contract to Oklo to provide power for an Alaskan air force base.

Clay Sell is the CEO of X-energy. He said that the problems at NuScale combined with macroeconomic factors and war in Ukraine and Gaze have had a chilling impact on its proposed merger. He went on to say, “When we announced our deal they [NuScale] were trading at a significant premium above their go public price and when we called off the transaction they were below $3. So there were certain realities about the market, which . . . put public equity providers in a risk-off situation.”

Despite these problems, Oklo said that it was confident that it could conclude its deal in the first quarter of 2024. Its reactors generate fifteen megawatts of electricity. They have significant advantages over existing technology, including being able to operate for ten years or more before they need to be refueled.

Please read Part 2 next