Part 2 of 2 Parts (Please read Part 1 first)

Nuclear fusion occurs when two atoms of light elements fuse together to form atoms of heavier elements. The energy released is huge. It is the same process that powers the stars, including our Sun. Nuclear fusion does not produce the same kind of long-lasting radioactive waste.

It is very hard to create the fusion reaction on Earth. However, nuclear fusion could create virtually limitless quantities of energy with no greenhouse gas emissions and no long-lasting radioactive waste. This means that it has become an area of intense interest to scientists and innovators working to commercialize the process as a solution to climate change.

Private fusion companies have raised about five billion dollars to scale nuclear fusion technology up to commercial energy production. The decision from the NRC on how the nuclear fusion industry would be regulated is a big deal for companies involved in fusion research.

Pravesh Patel is the scientific director for fusion startup Focused Energy. He said, “I think this decision and the clarity it brings is very positive for the fusion industry and removes a major area of uncertainty for the industry.”

Commonwealth Fusion Systems (CFS) is a startup spawned by MIT that has raised more than two billion dollars from a notable collection of investors. CFS also supports the new decision on fusion regulation by the NRC, calling it “a regulatory approach that will enable the U.S. to be a global leader in commercial fusion energy.”

Helion is another fusion startup in Redmond, Washington. They say that the decision leaves the road open for it to deliver its stated goals. Sachin Desai is the general counsel for Helion. He said, “This approach provides a clear and effective regulatory path for Helion to deploy clean, safe and effective fusion energy.” He added, “It is now incumbent on us to demonstrate our safety case as we bring fusion to the grid, and we look forward to working with the public and regulatory community closely on our first deployments.”

The approach to regulating nuclear fusion energy production is similar to the regulatory regime that is currently being employed to regulate particle accelerators. These are machines that make elementary nuclear particles, such as electrons or protons, move very fast. Particle accelerators are fundamental to high energy physics research. They have been used to innovate in a wide variety of industries.

Technically speaking, nuclear fusion will be regulated under Part 30 of the Code of Federal Regulation. The regulatory structure for nuclear fission is under Part 50 of that code.

Jeff Merrifield is a former NRC Commissioner. He said, “The regulatory structure needed to regulate particle accelerators under Part 30, is far simpler, less costly and more efficient than the more complicated rules imposed on fission reactors under Part 50. By making this decision to use the Part 30, the commission recognized the decreased risk of fusion technologies when compared with traditional nuclear reactors and has imposed a framework that more appropriately aligns the risks and the regulations.”

Blog

-

Nuclear Regulatory Commission Issues New Regulations For Nuclear Fusion Reactors – Part 2 of 2 Parts

-

Nuclear News Roundup Apr 28, 2023

Construction begins of third unit at Egypt’s El Dabaa nuclear power plant world-nuclear-news.org

State takeover of EDF resumes after appeal dismissed world-nuclear-news.org

Korea starts construction of new research reactor world-nuclear-news.org

South Korea presses China to address Pyongyang nuclear threat japantimes.co.jp

-

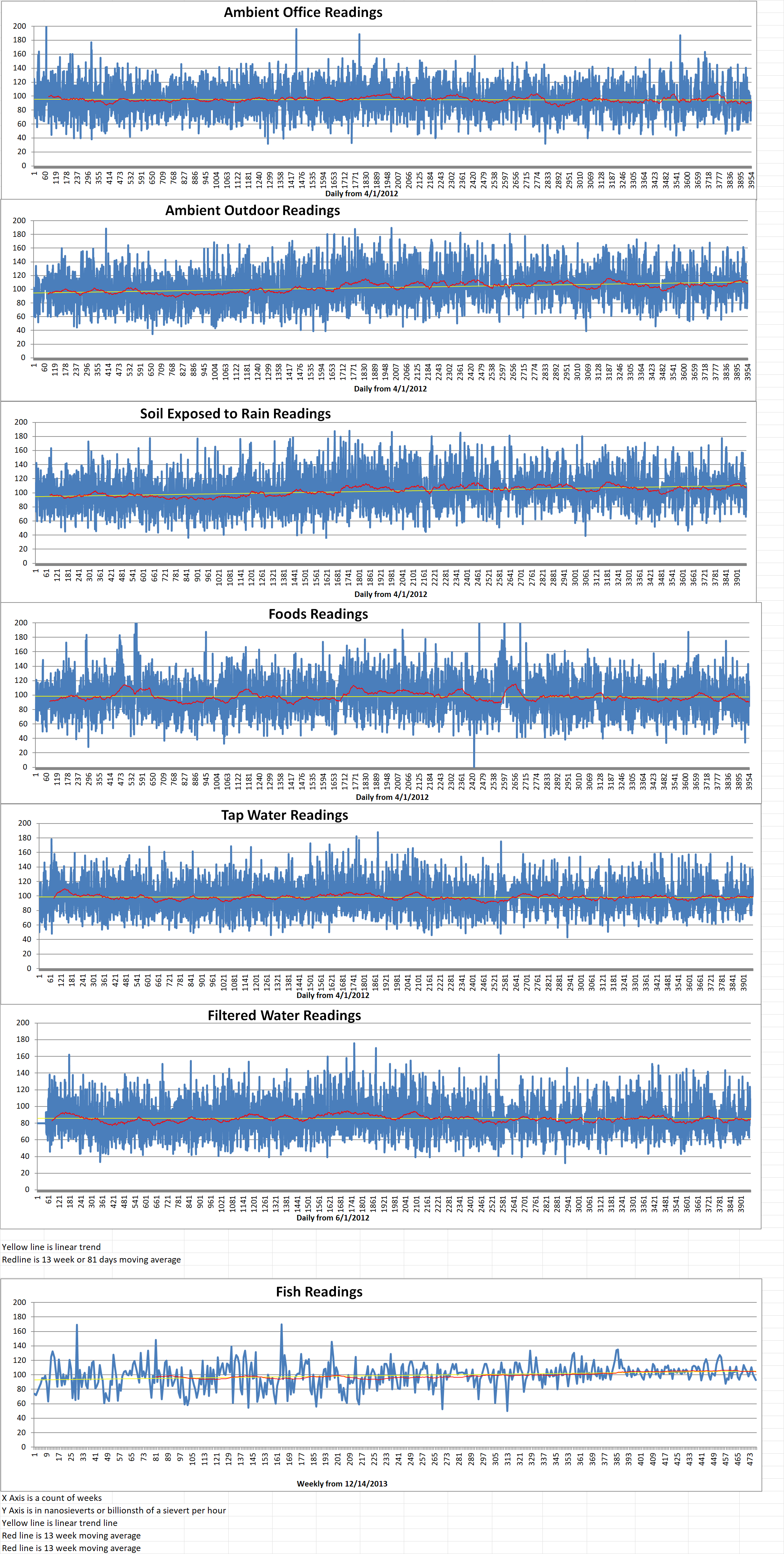

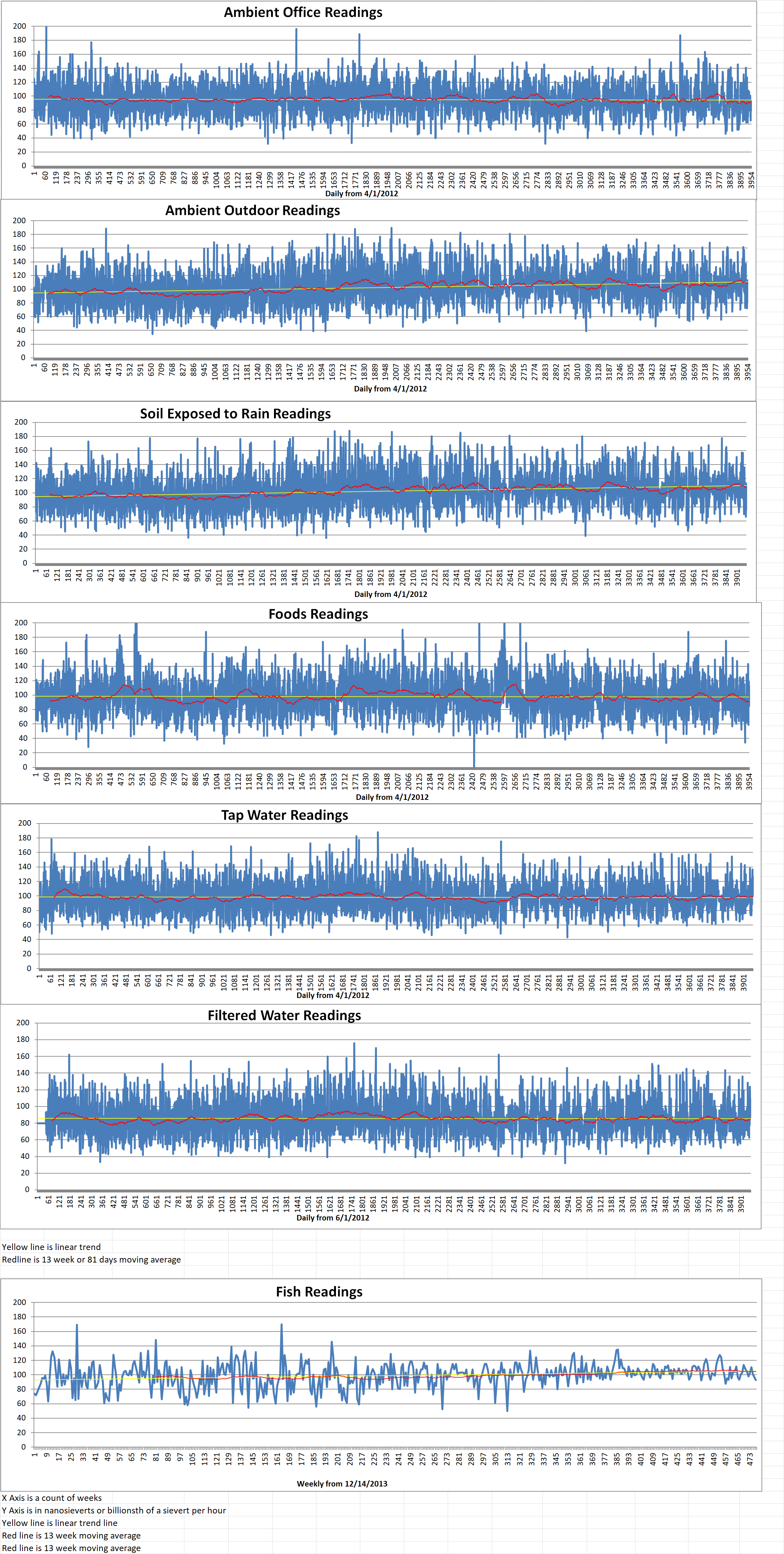

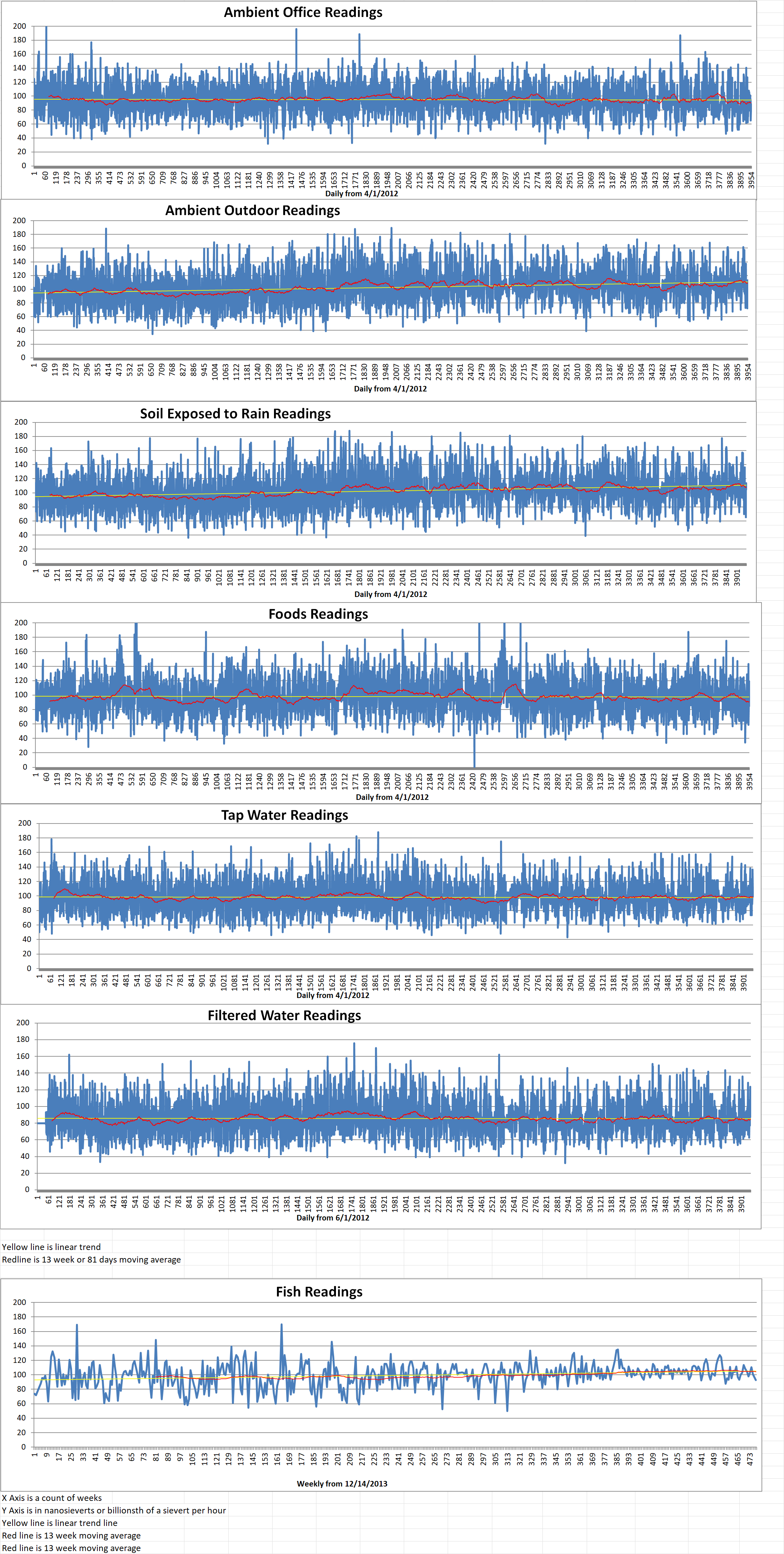

Geiger Readings for Apr 28, 2023

Ambient office = 93 nanosieverts per hour

Ambient outside = 81 nanosieverts per hour

Soil exposed to rain water = 76 nanosieverts per hour

English cucumber from Central Market = 86 nanosieverts per hour

Tap water = 126 nanosieverts per hour

Filter water = 109 nanosieverts per hour

-

Nuclear Regulatory Commission Issues New Regulations For Nuclear Fusion Reactors – Part 1 of 2 Parts

Part 1 of 2 Parts

Today, nuclear power refers to nuclear fission. Although nuclear fusion has been researched for decades, until recently, experts said that commercial nuclear fusion power was still decades away. Now billions of dollars are being invested in the worldwide race to harness nuclear power. Dozens of companies, universities, and government sponsored research facilities are using a variety of approaches to create practical fusion reactors. Many of the researchers hope to see prototypes of commercial fusion power reactors arriving withing the next ten years.

The Nuclear Regulatory Commission is the top regulatory agency for nuclear materials safety in the U.S. On April 14, it voted unanimously to regulate the growing nuclear fusion industry differently than the nuclear fission industry. Fusion startups are celebrating this as a major win. As a result of this vote, some regulatory provisions, specific to fission reactors, like requiring funding to cover claims from nuclear meltdowns, won’t apply to fusion power plants because fusion reactors cannot melt down.

Andrew Holland is the CEO of the industry group, the Fusion Industry Association. He said, “Up until now, there was real uncertainty about how fusion would be regulated in the United States — this decision makes clear who will regulate fusion-energy facilities, and what developers will have to do to meet those regulations. It is extremely important.”

Other differences between nuclear fission regulation and nuclear fusion regulation include looser requirements around foreign ownership of nuclear fusion power plants as well as the dispensing of mandatory hearings at the federal level during the licensing process, according to Holland.

The decision to develop fusion specific regulations had been under consideration for some time. On January 4th, the staff of the NRC submitted three recommendations to the commission’s decision making committee for how to regulate fusion.

Scott Burnell is a spokesperson for the NRC. He said that the options were to regulate fusion in the same way that fission is regulated, regulate fusion based on materials involved in the process or to take a hybrid approach.

Burnell said that in that submission, the NRC staff suggested regulating fusion like fission “is a poor fit with our rules, Nevertheless, the decision was not final until the full commissioned voted to chose to agree with that position.

There are currently ninety-three commercial nuclear fission reactors operating in the U.S. They generate energy when a neutron collides with an atom, splitting it into atoms of lighter elements and releasing huge amounts of energy. The electricity generated by nuclear fission is considered to be a form of clean energy by the U.S. Department of Energy (DoE) because it generates no greenhouse gas emissions during normal operations. This does not account for greenhouse gas emitted during mining, conversion, enrichment, transport, reactor construction and the decommissioning process. Half of the energy categorized as carbon-free generated in the U.S. comes from nuclear fission reactors. However, these types of reactors also produce spent nuclear fuel waste that remains radioactive for thousands of years.

Please read Part 2 next -

Geiger Readings for Apr 27, 2023

Ambient office = 88 nanosieverts per hour

Ambient outside = 08 nanosieverts per hour

Soil exposed to rain water = 105 nanosieverts per hour

Blueberry from Central Market = 112 nanosieverts per hour

Tap water = 111 nanosieverts per hour

Filter water = 94 nanosieverts per hour

-

Nuclear News Roundup Apr 27, 2023

IAEA Begins to Reinstall Cameras in Iran armscontrol.org

Georgia nuclear plant’s 4th reactor one step closer to generating electricity foxnews.com

U.S Navy begins planning to decommission Nimitz nuclear power carrier businessinsider.com

Special inspection underway at nuclear plant in Calvert County somdnews.com

-

the UK, the US, Canada, Japan and France Are Working To Reduce Dependence On Russian Nuclear Fuel and Technology – Part 3 of 3 Parts

Part 3 of 3 Parts (Please read Part 1 and Part 2 first)

The Western nuclear states still retain significant nuclear capabilities and the U.K. Government, and its allies, are now taking steps to weaken the Kremlin’s hold on the market.

Part of this is expected to involve greater sanctions on Rosatom. The U.S. recently unveiled sanctions on a bunch of the company’s foreign subsidiaries. The E.U. is considering sanctions on the company itself with support from Germany. However, these actions will require the kind of boost to domestic production that has not been seen in generations.

U.S. based Westinghouse received sixteen million dollars to revive its uranium conversion facility in Springields, Lancashire, where it already fabricates nuclear fuel assemblies. The site will be ready to go into production by 2028.

Westinghouse has developed a method for making the Russian-style hexagonal fuel assemblies itself and has signed deals to provide them to Czechia and Bulgaria. One nuclear industry analyst says that the new product is named “freedom fuel.” The company is already providing them to Ukraine, another country that uses Russian reactors.

Urenco is the British-German-Dutch nuclear company partly owned by the U.K. Government. It has stated that it will also expand its enrichment capacity, including its site in Capenhurst, Cheshire.

There is also more capacity for uranium conversion in Canada, the U.S. and France. Dolzikova said, “So it’s not a technical issue, but rather an issue of political will.”

Another possible new source of nuclear fuel could be recycling. As part of its expansion of Springfields, Westinghouse is developing a reprocessing facility, where uranium from spent nuclear fuel is recycled and used again. It will be the only such recycling facility outside of Russia.

Bruce Hanson is a professor of nuclear process engineering at Leeds University who worked in the nuclear industry for more than 25 years. He says that reprocessing was previously done in the U.IK. but now is seen as too expensive to be economically viable. It is cheaper to simply make new nuclear fuel.

Future efficiency improvements as well as growing demand for uranium from China could change the situation. Reprocessing is also considered to be more sustainable, he argues. Hanson goes on to say, “I think if you were to go out and ask people, ‘Should we be throwing out nuclear [waste] if we can recycle it?’, I’m pretty sure what most of the British public would say – they’d say we should be recycling it.”

Hill says that success in jump-starting nuclear recycling will be a matter of perseverance and giving companies enough certainty to invest. The nuclear business is a long game. Companies will not commit if they think the sanctions on Russia will simply be rolled back in a year or two. Westinghouse previously closed its conversion facility in Springfields in 2014 because there was not enough demand for nuclear fuel from its customers.

This is likely to push the cost of nuclear fuel higher, at least temporarily. Dolzikova warns that China may also see it as an opportunity to gain market share from Russia. This would see the West swapping one dependency for another.

Hill argues that the trouble would certainly be worth it. He said, “The extra costs of switching from Russian to Western fuel will easily be worth the security of supply and energy security benefits, particularly for countries in Eastern Europe. So it’s a challenge, but it’s a very doable challenge. It will just require close cooperation, clear objectives and concrete action.” -

Nuclear News Roundup Apr 26, 2023

Fourth reactor at Georgia nuclear plant completes test phase wspa.com

Tokamak Energy magnet technology to be tested in USA world-nuclear-news.org

Nuclear Missile Base Cancer indexjournal.com

Indian companies sign agreement for nuclear plant construction world-nuclear-news.org

-

Geiger Readings for Apr 26, 2023

Ambient office = 79 nanosieverts per hour

Ambient outside = 113 nanosieverts per hour

Soil exposed to rain water = 114 nanosieverts per hour

Avocado from Central Market = 85 nanosieverts per hour

Tap water = 104 nanosieverts per hour

Filter water = 90 nanosieverts per hour

-

Nuclear Reactors 1211 – the UK, the US, Canada, Japan and France Are Working To Reduce Dependence On Russian Nuclear Fuel and Technology – Part 2 of 3 Parts

Part 2 of 3 Parts (Please read Part 1 first)

Russian nuclear fuel and technology dominance is party enforced through a web of contracts that the state-owned monopoly has with nations around the world. Many of these are former Soviet bloc states which are running Russia made reactors. They were left reliant on Rosatom for parts and fuel when the Soviet Union collapsed.

These “VVER” power stations are still in use by NATO members Turkey, Finland, Czechia, Bulgaria and Hungary. Other customers include India and China. Myanmar and Egypt are among nations who recently signed deals with Rosatom to build new reactors with Russian help.

Eugene Shwageraus is a professor of nuclear systems engineering at the Open University. He says that persuading any of these countries to stop using Russian supplies will be hard for a practical reason. Russian VVER reactors use hexagonal-shaped fuel assemblies. This is a nuclear industry term for groups of fuel rods. The Western nuclear fuel design use square shaped fuel assemblies.

Unfortunately, some Western nations that are not dependent on Russian nuclear fuel and technology have become more dependent on Russia since the fall of the Berlin Wall in 1989.

Under the Megatons to Megawatts arrangement, the U.S. agreed to purchase thousands of metric tons of uranium that was removed from nuclear weapons as Russia reduced its enormous arsenal of nuclear warheads. At one point this arrangement provided about ten percent of the nuclear fuel burned in U.S. nuclear power stations.

Overall, about thirty-one percent of the enriched uranium sold to E.U. utility companies came from Rosatom in 2021. Twenty eight percent of the enriched uranium used by the U.S. in 2021 came from Rosatom. These imports of enriched uranium have continued since Russia attacked Ukraine in 2022.

France supplies other allies with fabricated nucleal fuel. France imported four hundred million dollars’ worth of enriched uranium from Russia last year. In 2021, France only imported about one hundred million dollars of enriched uranium from Russia. This information was provided by the Royal United Services Institute (RUSI).

The U.S. imported six hundred and forty-five million dollars’ worth of enriched uranium in 2021 and eight hundred and thirty-five million dollars’ worth in 2022.

In the U.K., EDF, the French owned nuclear company, says that fuel used by the Sizewell B nuclear power plant in Suffolk was made using uranium enriched by Russia. Sarya Dolzikova is a research fellow at RUSI. She says that there is some evidence to suggest that Russia has made about one billion dollars from nuclear exports since the Ukrainian invasion began. She explained that “In terms of the amount of money that it brings into the Russian economy, it is not as significant as some of the other energy exports. But at the same time, that might make it a little bit easier to dismiss – even though it is a good chunk of money.”

Industry insiders say that state-backed Rosatom has spread its influence so far by using very low prices. This has made it difficult for other nuclear fuel and technology suppliers to compete.

Please read Part 3 next