The Massachusetts Institute of Technology has been involved in nuclear fusion research for over twenty five years. Dennis Whyte is the head of MIT’s Plasma Science and Fusion Center. In 2014 he taught a class whose class project was aimed at reducing the cost of nuclear fusion reactors. The class developed a new fusion reactor design that they called “ARC” which stands for affordable, robust and compact. Unfortunately, the cost estimate for the ARC reactor was still a few billion dollars which was considered to be rather high to attract investors. The class continued working to develop a reactor design which would be the cheapest possible design for a fusion reactor that would produce more energy than it consumed.

Commonwealth Fusion Systems (CFS) is a private startup that is result of the work by Dennis Whyte’s class. CFS received its first sixty-four million dollars from several investors. These investors include Eni, an Italian energy company, Breakthrough Energy Ventures, a consortium of some of the world’s richest individuals and The Engine, an MIT program dedicated to investing frontier technologies. Another fifty million dollars has just been raised from Future Ventures, Chris Sacca’s Lowercase Capital, Moore Strategic Ventures, Safar Partners, Schooner Capital and Starlight Ventures.

CFS hopes to have its smallest possible nuclear fusion reactor built by 2025. One of the key elements of the new CFS fusion reactor is reliance on proprietary magnetic technology for plasma confinement developed at MIT.

Bob Mumgaard is the chief executive of Commonwealth Fusion Systems. He says, “CFS is on track to commercialize fusion and deliver an inherently safe, globally scalable, carbon-free, and limitless energy source.” The goal for the first CFS reactor is to produce fifty megawatts of electricity. Their next goal will be a model that can generate two hundred megawatts of electricity.

Mumgaard says that “The hazard profile of fusion continues to put it in [the category of] an industrial facility. The laws exist, but we haven’t gone out and built the plant yet, so no one has the precedent. You have to keep track of moving towards vs. going to get to. The consensus is we do not have a solution in hand for deep decarbonization of the electricity grid. if you look at where the biggest gains even in renewables. the biggest gains are in the utility scale where you’re talking hundreds of megawatts of power per site.” Mumgaard does not believe that renewable sources of energy can provide the huge energy demand of modern cities.

Steve Jurvetson is the chief executive of Future Ventures. In a recent statement, Jurvetson said, “We have been looking for the right clean energy investment opportunity in fusion for the past 20 years. We wanted a company that was ready to make a business of fusion and we have finally found it with Commonwealth Fusion Systems. The hard science from which their approach is based has been proven by this team as well as leaders in the field around the world. With some clever engineering, CFS is ready to harness the power of the solar cycle to change the world and usher in the era of clean baseload energy generation for the betterment of all.”

Blog

-

Nuclear Fusion 61 – MIT Spinoff Commonwealth Fusion Systems Expects To Have Working Fusion Reactor by 2025

-

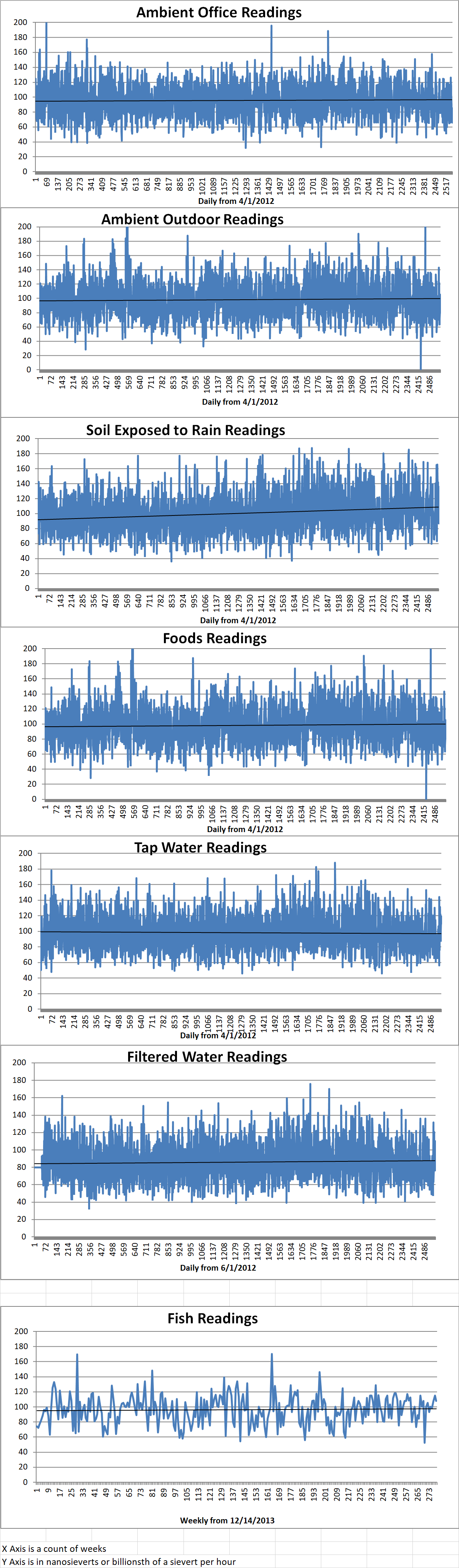

Geiger Readings for Jun 28, 2019

Ambient office = 66 nanosieverts per hour

Ambient outside = 87 nanosieverts per hour

Soil exposed to rain water = 87 nanosieverts per hour

Avocado from Central Market = 80 nanosieverts per hour

Tap water = 110 nanosieverts per hour

Filtered water = 94 nanosieverts per hour

-

Nuclear Reactors 690 – Problems With Booming Market In Decommissioning – Part 2 of 2 Parts

Part 2 of 2 Parts (Please read Part 1 first)

This era of nuclear safety corresponded to the time when nuclear power plants were operational and generating electricity. Once a plant is permanently shuttered, there are no operating profits. Now the only way to maximize profits is to minimize costs. Companies specializing in decommissioning such as Holtec will work hard to figure out how to carry out decommissioning as cheaply as profitable.

Reputational incentives also change. When a plant is operating, the owners are concerned about any problem at any plant that could impact their reputation and their whole business including non-nuclear assets. However, when a nuclear power plant is sold to a small decommissioning firm, there is a lot less at stake if problems are encountered.

And, finally, there is the question of bankruptcy. A company the size of Entergy with a nineteen-billion dollar market capitalization could only be put out of business by a very large incident. That is not the case for a smaller company. Economists have argued that bankruptcy protection raises a “moral hazard” problem. Judgement proof companies have a lot less incentive to act safely.

There is a similar “moral hazard” with respect to oil and gas wells. Analysts say that small oil and gas producers face adverse incentives with regard to safety and environmental risk. If a small gas and oil producer declares bankruptcy, they are not held responsible for accident cleanup costs. This can lead them to be less concerned about safe operating practices. The American West has thousands of “abandoned” wells that have not been properly remediated. Many of these wells are “owned” by companies that have filed for bankruptcy. The same sorts of problems have shown up with respect to coal mines and off-shore oil drilling platforms. The stakes for the nuclear industry are even higher than the stakes in fossil fuel cleanup. It is anticipated that the cleanup of closed nuclear power plants will run into the billions of dollars.

There are valid concerns that economic incentives are not enough to ensure safe and complete decommissioning. Companies which purchase shuttered nuclear power plants to decommissions are inheriting significant decommissioning funds that have been extracted from owners and operators. The Nuclear Regulatory Commission (NRC) has claimed that it will closely monitor financial viability closely during the decommissioning process. Some analysts have raised the question of what would happen if a decommissioning company ran out of money before the process was complete. Who will pay the addition costs if the decommissioning funds are not sufficient to pay all the costs?

The NRC is obviously the organization that must deal with this question. As more and more U.S. nuclear power reactors are retired, the focus of the NRC should shift from regulating construction and operation to regulating decommissioning and spent fuel storage. The NRC must move quickly to prepare for emerging risks in the commercialization of decommissioning.

The companies decommissioning recently closed nuclear power plants want to accelerate the timeline for decommissioning. This could be either good or bad for public safety depending on how closely decommissioning is monitored. The companies buying nuclear power plants for decommissioning require special expertise and equipment to carry out decommissioning tasks quickly and competently. This could be beneficial to the public if done right. However, some analysts say that the incentives to properly carry out decommissioning are not very compelling, and it is an open question whether or not the NRC will be able to competently regulate decommissioning. -

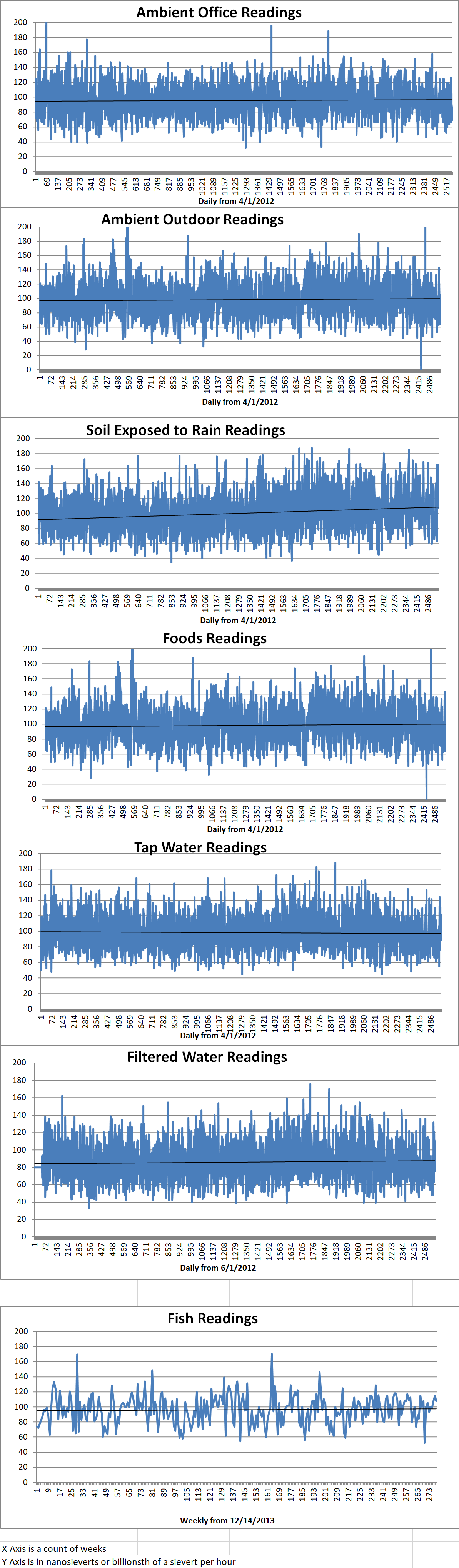

Geiger Readings for Jun 27, 2019

Ambient office = 78 nanosieverts per hour

Ambient outside = 136 nanosieverts per hour

Soil exposed to rain water = 136 nanosieverts per hour

Carrot from Central Market = 105 nanosieverts per hour

Tap water = 115 nanosieverts per hour

Filtered water = 110 nanosieverts per hour

-

Nuclear Reactors 689 – Problems With Booming Market In Decommissioning – Part 1 of 2 Parts

Part 1 of 2 Parts

A few days ago, I posted about the booming market in decommissioning nuclear reactors. That post spoke of the number of reactors that will need to be decommissioned in the near future and the business opportunities that are offered. It turns out that there are some serious problems with the rush to decommission.

Holtec International just received federal permission to purchase New Jersey’s Oyster Creek nuclear power plant. Oyster Creek was permanently closed down last fall. Holtec bought the plant to decommission which includes the management of spent nuclear fuel and other radioactive wastes. This transaction is one of several recent deals where a small privately-owned company specializing in decommissioning purchased a nuclear power plant from a big publicly-traded company. Considering that more such sales are being carried out, it is past time to consider what implications there might be in such transactions with respect to the safety of the public and the environment.

The nuclear industry in the U.S. has an excellent record of safe operations. Most owners of nuclear power plants in the U.S. have been big utility companies with a lot to lose with respect to reputation and profits if something goes wrong at a nuclear power plant that they own and operate. The question has been raised as to whether or not much smaller companies have the same incentives with respect to ownership of nuclear power plants.

On of the biggest sellers of nuclear power plants is a company named Entergy. Entergy is selling the Vermont Yankee plant which closed in 2016, the Pilgrim nuclear power plant in Massachusetts which closed in 2019, the Indian Point plant in New York which is closing in 2021, and the Palisades nuclear power plant in Michigan which is closing in 2022. Entergy and Exelon which is selling Oyster Creek are big, publicly traded companies. Entergy has a market capitalization of nineteen billion dollars. Exelon has a has a market capitalization of forty-eight billion.

In contrast to the sellers, the buyers are small privately held companies. Holtec International which is decommissioning Oyster Creek has special expertise and equipment for decommissioning, spent fuel storage, nuclear materials transport and other services for the nuclear industry. NorthStar Group Services (NGS) is buying the Pilgrim nuclear power plant. NGS is another small, privately-owned company which offers specialized facility service contracting.

These buyers are better suited to manage the decommissioning process. These specialized companies will be able to bring their expertise to carry out safe and complete decommissioning. Big companies such as Entergy and Exelon on the other hand have to manage a large number of different projects and sites and may not have the expertise and equipment required for decommissioning.

There is also the possibility that these transfers of nuclear assets could come with big problems. With respect to operating nuclear power plants, safe operation meant more profits. These economic incentives likely contribute to the good safety record of the U.S. nuclear industry. Nuclear plant owners exert considerable effort to avoid problems because those problems might require that a plant be shut down while they are dealt with. Shutting down a plant means a significant loss of profit.

At the peak of its involvement in nuclear power generation, Entergy owned and operating eight nuclear power plants. These plants generated over nine gigawatts of nuclear capacity. With such a large investment in nuclear power, Entergy had a huge incentive to keep all of its plants running without serious incidents. Safe nuclear power is profitable nuclear power.

Please read Part 2 -

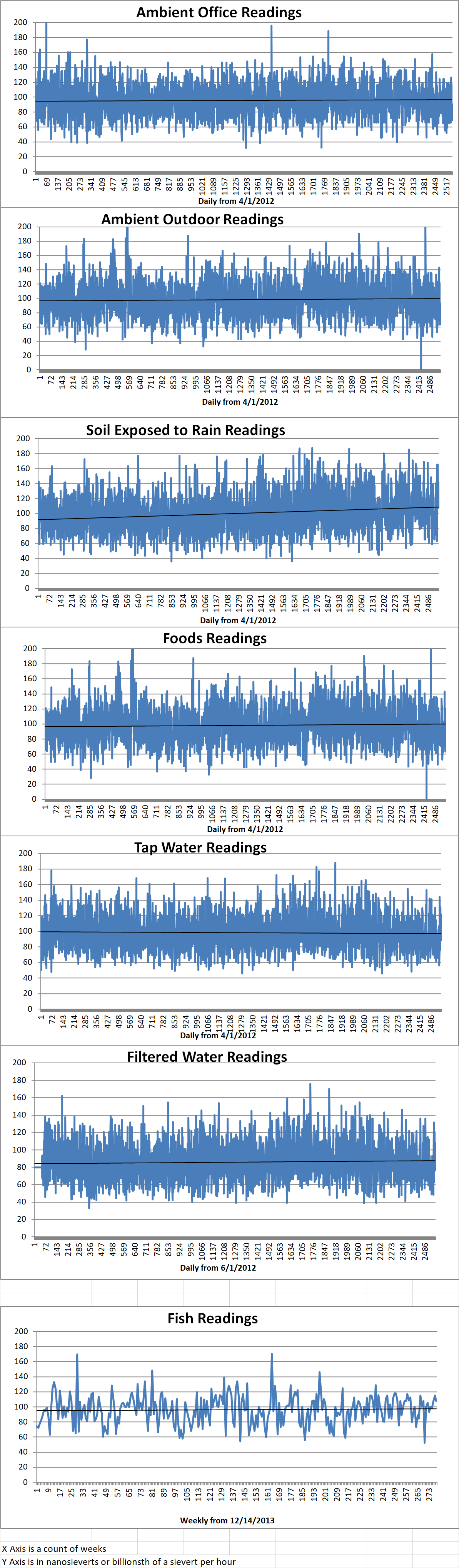

Geiger Readings for Jun 26, 2019

Ambient office = 85 nanosieverts per hour

Ambient outside = 108 nanosieverts per hour

Soil exposed to rain water = 108 nanosieverts per hour

Vine ripened tomato from Central Market = 93 nanosieverts per hour

Tap water = 119 nanosieverts per hour

Filtered water = 102 nanosieverts per hour

-

Nuclear Weapons 689 – Dangers Of AI To The Control Of Nuclear Arsenals

Many movies, TV shows and novels feature military artificial intelligence systems that are hacked to either start a nuclear war or create the illusion that a nuclear war has been started which invites retaliation. With advances in nuclear weapons systems and artificial intelligence, what had been fiction is moving closer to being a real threat to the world.

The International Campaign to Abolish Nuclear Weapons (ICANW) is a non-profit organization dedicated to the elimination of nuclear weapons. The ICANW won the Nobel Peace Prize in 2017 for its fight against nuclear weapons.

Beatrice Fihn is the executive director of the ICANW. She recently raised concerns about AI and nuclear weapons. She is afraid that the dangers of hackers either launching an attack or tricking a nuclear armed nation into launching an attack is increasing and needs to discussed and dealt with. We now have computer programs that can create fake videos in which anyone can be made to say anything. Hackers might use this “deep fake” technology to fool leaders of a nation with nuclear weapons to believe that leaders of another country are preparing a pre-emptive nuclear strike.

Fihn told an interviewer that she would like to call a meeting this fall with nuclear weapons experts and some of the leading companies in AI and cybersecurity. This event would be “off-the-record” but would produce a document that ICANW could distribute to governments and other organizations and individuals which would warn them of the danger.

She said, “Some companies are more powerful than governments today in terms of shaping the world,” Fihn said. She wants to “engage them in thinking about how they can contribute to a more sustainable world, one that reduces the threat of extinction.” So far, Microsoft, Google’s Deep Mind AI division and other companies leading AI research have expressed an interest in contributing to the ICANW project but decline to comment to the press. Fihn says that some of these companies know that it is an important subject, but they are intimidated by it.

Generally, AI has a good reputation and is described as being a boon to the world. Extensive use in medicine are improving therapies and self-driving cars will reduce accidents. But there is also a fear of AI out of control that has been portrayed in the media and is a subject of debate among intellectuals. Fihn says “We don’t want to advocate for any restrictions on A.I. But this technological development is happening—we have to be very careful.” Fihn wonders if AI poses realistic dangers or are concerns being driven by overactive imaginations.

Fihn points out that there is a great deal of secrecy involved in the control systems for launching nuclear weapons. This makes it difficult to know just how far AI has penetrated into these critical systems. It is generally understood that hacking is a serious danger to the control of nuclear arsenals.

Many years ago, a cynic coined the term “cybercrud.” He defined it as blaming computer systems when it is really human incompetence that caused problems. I think it is safe to say that we have as much to fear from human error as from AI.