Blog

-

Geiger Readings for May 25, 2015

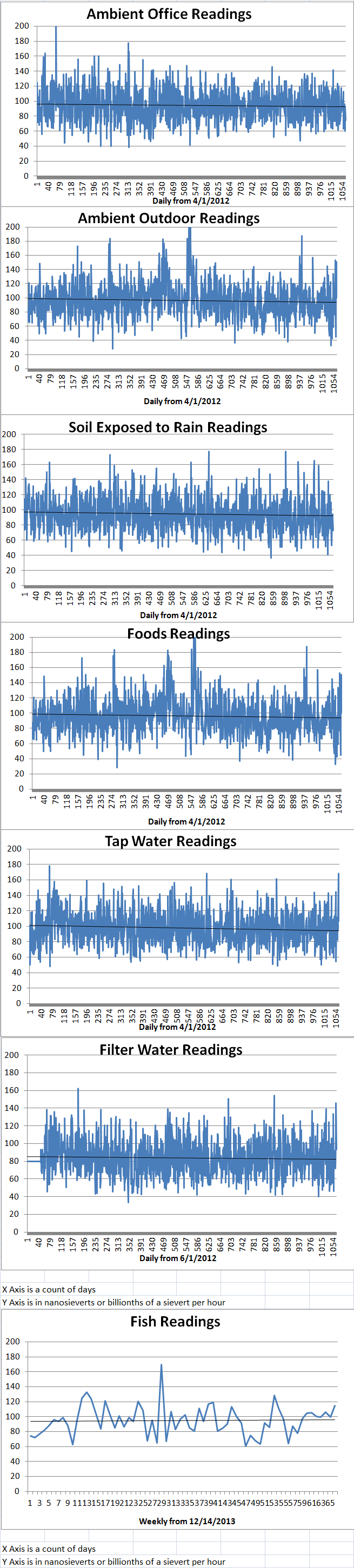

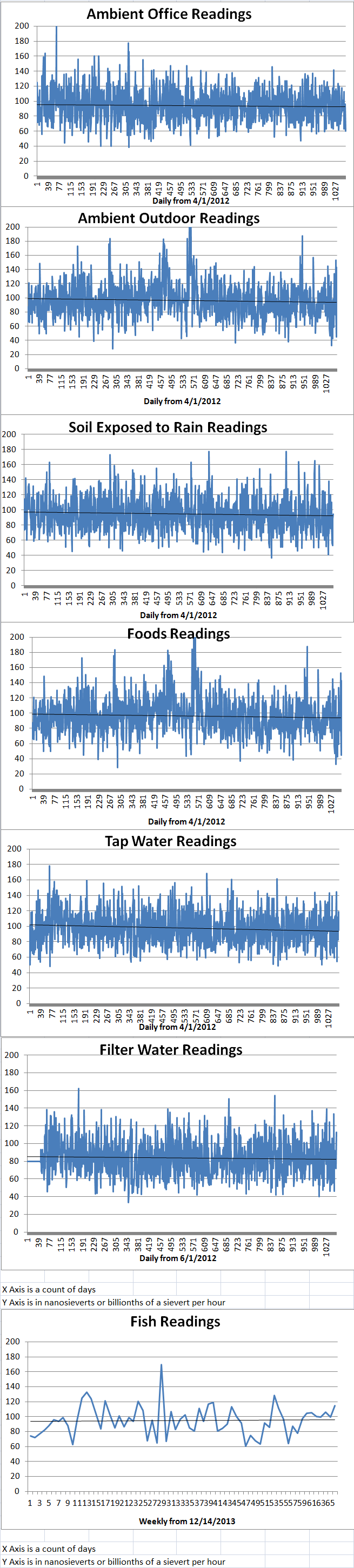

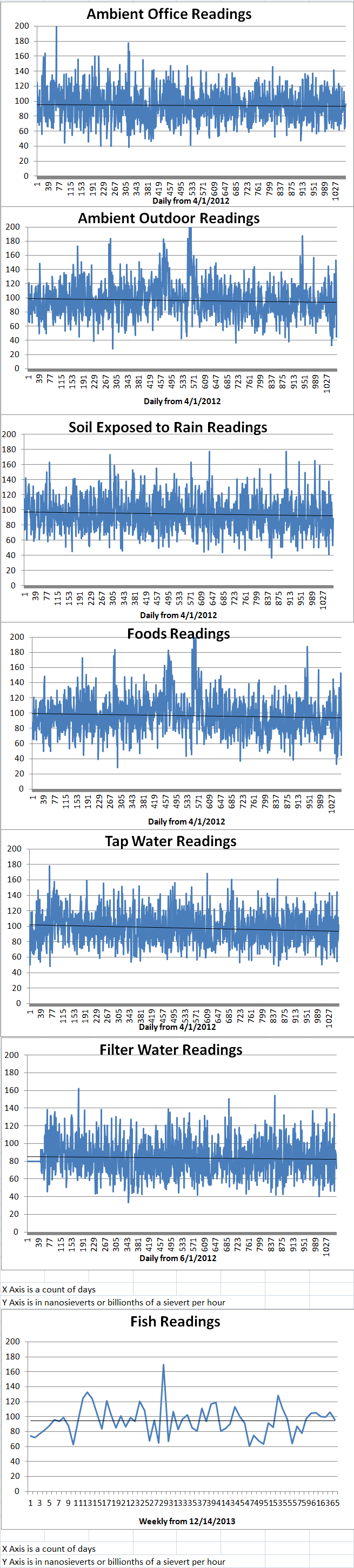

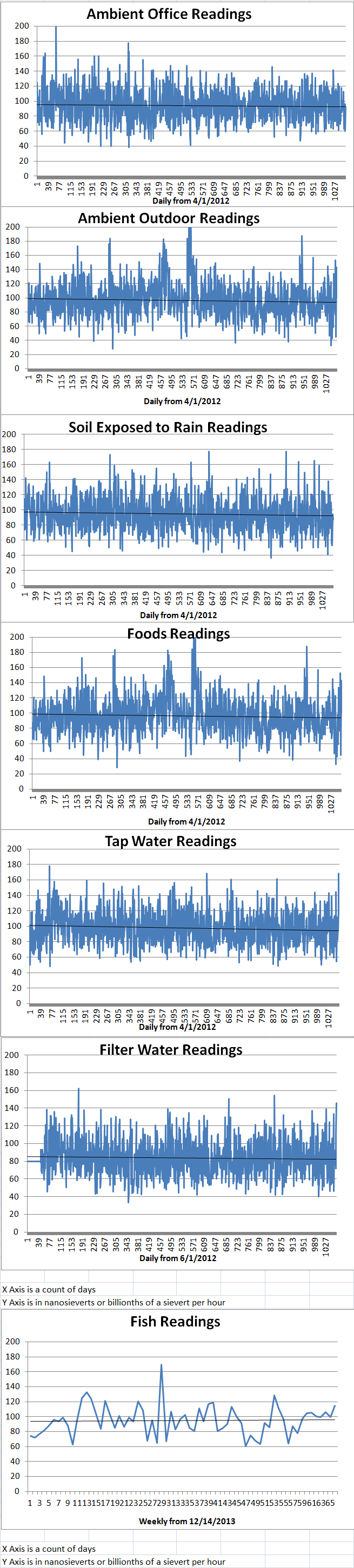

Ambient office = 74 nanosieverts per hourAmbient outside = 81 nanosieverts per hourSoil exposed to rain water = 73 nanosieverts per hourVine ripened tomato from Central Market = 153 nanosieverts per hourTap water = 197 nanosieverts per hourFiltered water = 93 nanosieverts per hour -

Geiger Readings for May 24, 2015

Ambient office = 93 nanosieverts per hourAmbient outside = 79 nanosieverts per hourSoil exposed to rain water = 87 nanosieverts per hourCelery from Central Market = 100 nanosieverts per hourTap water = 169 nanosieverts per hourFiltered water = 145 nanosieverts per hour -

Geiger Readings for May 23, 2015

Ambient office = 60 nanosieverts per hourAmbient outside = 92 nanosieverts per hourSoil exposed to rain water = 94 nanosieverts per hourRedleaf lettuce from Central Market = 143 nanosieverts per hourTap water = 119 nanosieverts per hourFiltered water = 113 nanosieverts per hourHalibut Cheeks – Caught in USA = 115 nanosieverts per hour -

Nuclear Reactors 243 – Problems in the Russian Nuclear Export Industry – Part Two of Three Parts

Part Two of Three Parts (Please read Part One first)

Until the announced cut-off of financing from the Russian government, Rosatom had almost limitless financial support for their international nuclear sales deals. This gave Russia a distinct advantage in pursuing international markets for its reactors. There were no other nuclear reactors export countries whose taxpayers would fully finance almost the entire cost of a new nuclear reactor for another country. In recent years, this financial support has been instrumental in Russia signing nuclear construction contracts with Finland, Hungary, and Belarus.

Rosatom has been seeking deals in Europe for the sale and construction of nuclear power reactors. Russia is promoting the VVER-1200 reactor for an official price of about five and a half billion dollars. However, as is often the case in the nuclear industry, the actual price of a Russian reactors based on the Hanhikivi NPP deal in Finland suggests that the price per Russian reactor will be more likely be around eight billion dollars.

The deal with Hungary had Russia providing a loan of about nine billion dollars to cover eighty percent of the cost of two new Russian VVER-1200 to replace a pair of old Russian VVER-440 reactors at the Paks Nuclear Power Plant. However, the European Commission has been blocking the project from completion because the contract calls for Russia to have exclusive rights to refuel the reactors. European Union rules call for multiple suppliers to be able to bid on fuel supply contracts for EU members. There are no other VVER-1200 reactors operating anywhere in the world and Russia owns exclusive rights to the technology for manufacturing the fuel assemblies. Either Russia would have to abandon the project or share its proprietary fuel assembly technology with other nuclear fuel vendors. There is a proposal that Russia be granted exclusive fueling rights for ten years and that other fuel vendors be allowed to bid on refueling after that. However, there are legal challenges to the original contract because there was no open bidding process for fuel supply before the deal was signed.

Russia’s attempt to sell new reactors to Belarus was foiled after a deal had been struck by a change of government in 2011. A new team of independent investigators hired by the new government went over the details of the propose Russian reactor sale and concluded that the new nuclear power plant would cost a great deal more than the estimated cost in contract that had been signed.

So far, the Russian attempt to penetrate the EU nuclear power reactor market has failed despite enormous Russian investment in that project. At this point, the only Russia reactors in the EU are old reactors left over from the era of the Soviet Union.

Russia had also signed deals with the old government of Ukraine for new nuclear power reactors but, with the annexation of the Crimea and Western sanctions, contracts to complete the construction of Units 3 and 4 at the Khmelnitsky Nuclear Power Plant in Ukraine were put on indefinite hold.

(See Part Three)

-

Radiation News Roundup May 22, 2015

First Japanese reactors prepare for restart. world-nuclear-news.org

-

Geiger Readings for May 22, 2015

Ambient office = 96 nanosieverts per hourAmbient outside = 112 nanosieverts per hourSoil exposed to rain water = 89 nanosieverts per hourYellow bell pepper from Central Market = 45 nanosieverts per hourTap water = 95 nanosieverts per hourFiltered water = 72 nanosieverts per hour -

Nuclear Reactors 242 – Problems in the Russian Nuclear Export Industry – Part One of Three Parts

Part One of Three Parts

There has been a lot of talk lately about a nuclear renaissance in the past few years. There has been a surge in new construction lately. In the nuclear nations, China and Russia are strongly committed to major domestic nuclear projects while new construction is rare in other nuclear nations. Nuclear technology companies in nuclear nations are seeking to export nuclear technology to developing nations to help them expand their economies. The most aggressive exporters are Russia’s Rosatom and France’s Areva. One of the big problems for the global nuclear industry these days is that the energy market is much freer these days with a flood of cheap natural gas and the lost of locked in prices for electricity generated by nuclear reactors. Unless nuclear companies have access to state subsidies as in Russia and France, it is difficult to interest investors in new nuclear ventures.

Rosatom is the Russian State Atomic Energy Corporation, the state owned conglomerate of nuclear companies in Russia. Atomenergoprom is part of Rosatom. It was formed in 2007 when more than 80 of the civilian nuclear companies under the Rosatom umbrella were consolidated into a nuclear holding company operating in all segments of the nuclear energy cycle. Atomenergoprom is dedicated to “large-scale development of nuclear energy in Russia and promotion of Russian nuclear technologies on the international markets.”

In January, Fitch, the international financial rating agency downgraded the ratings of thirteen of the largest Russian nuclear companies including Atomenergoprom to BBB-. This is the lowest category of investment-grade ratings. Having an investment grade rating means that a company has “adequate capacity for payment of financial commitments that may be impaired by adverse business or economic conditions.” The minus sign means that it is possible that a company will have it ratings lowered further in the future. If Atomenergoprom’s rating drops below BBB, that would mean that it would be reclassified to a speculative grade rating. A speculative grade rating means that a company with “an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time.”

Many segments of the Russia economy have been impacted Western trade sanctions triggered by the Russian annexation of the Crimea from Ukraine . Although the Russian energy sector has been hit by the sanctions, this has not included nuclear exports. Other than this down grading of credit ratings, the global nuclear industry is still pretty much a “level playing field.”

This is a critical year for Rosatom with regard to Russian state support. This will be the last year that Rosatom receives major government financing for the construction of new reactors. In 2016, the allowed expenses for Rosatom will be cut from around one billion seven hundred sixty million to seven hundred sixty million. That is a reduction of almost two thirds. This reduction in government support was planned before the trade sanctions were put into place and started impacting the Russian economy. If the Western sanctions are not removed soon, Rosatom may see further reduction in state support.

(See Part Two)