Part 3 of Part 4 (Please read Part 1 and Part 2 first)

The director for fuel cycle programs at industry trade group the Nuclear Energy Institute said, “It's slowed down the growth of nuclear globally and led to some countries cutting back or ending their nuclear program. Supply was not as quick to react to this huge loss of demand.”

The promised “nuclear renaissance” has not come to pass. New reactor builds in the U.S. such as the project in South Carolina have been cancelled after billions of dollars had been spent. Westinghouse, a major U.S. supplier of nuclear technology to the global nuclear market went bankrupt, partly as a result of over confidence in the expansion of the nuclear power reactor market.

Since uranium prices peaked in 2007, prices have fallen from one hundred forty-seven dollars a pound to a current price of between twenty and twenty-five dollars a pound. An analyst of the uranium mining industry said, “There's such a glut of inventory in the market that it's just not profitable for some of the mines to produce, so the price has just really plummeted as a result of that."

Both U.S. and Canadian uranium mining companies have suffered from falling uranium prices. Cameco is major Canadian uranium mining firm. It has just announced that it is going to close the biggest uranium mine in the world indefinitely. Originally, the company had intended to close the mine for ten months out of the year while it waited for the price for uranium to rise once again.

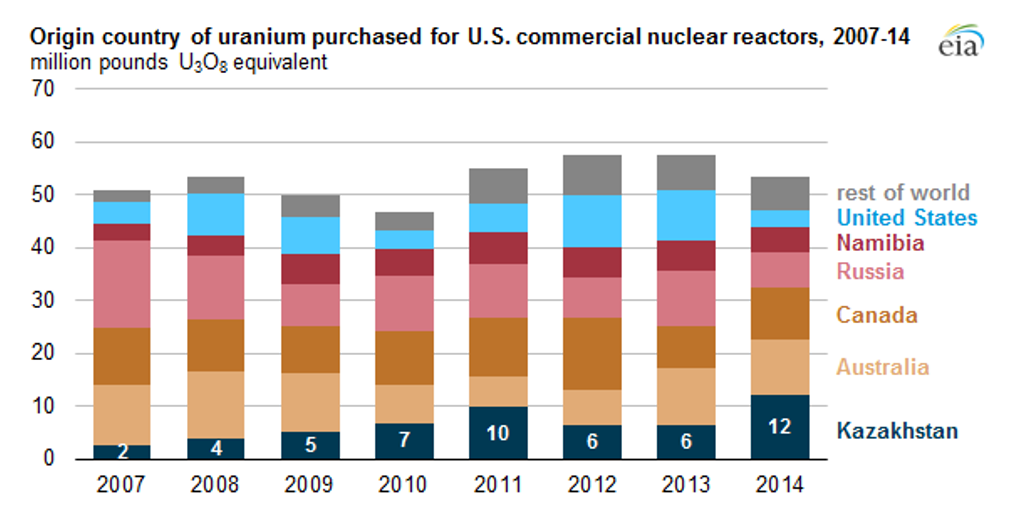

Energy Fuels and Ur-Energy asked the U.S. Department of Commerce to investigate whether or not the U.S. reliance on foreign uranium supplies is a risk to national security. The requested investigation began last month. One possible outcome could be for the U.S. to restore the old trade barriers to uranium import. This would guarantee that U.S. uranium miners would continue to be involved in supplying the U.S. military with uranium for fuel and weapons. The two private companies that called for the investigation want the U.S. to ensure that U.S. uranium producers control at least twenty-five percent of the U.S. uranium market. The companies complain that they cannot compete with uranium from countries such as Russia and Kazakhstan.

Currently, about one half of the uranium consumed in the U.S is supplied by Canada and Australia which are long-time allies of the U.S. Although these countries do not have state-subsidized uranium operations, U.S. uranium producers are having difficulties competing with them too.

A previous Department of Commerce investigation of U.S. uranium production in 1989 said that "One of the main problems beyond the U.S. industry's control is that the richest and most accessible uranium deposits are not found in the United States. The resources of Canada and Australia have higher uranium content and a lower production cost per unit.”

The report found that the current situation with respect to uranium mining and importation of foreign uranium did, in fact, injure domestic uranium producers. George H. W. Bush, the new U.S. president inaugurated in 1990, took no action with respect to the conclusions of the 1989 investigation.

Please read Part 4