Last week the European Commission (EC) began an investigation into the support that the British government is giving to the project to construct a new reactor at Hinkley Point C in Somerset. The Chinese have bought into the project which has concerned some departments in the British Government that deal with foreign investment in British projects. Two Areva ERP reactor reactors are to be built by EDF, the French nuclear contactor. The new reactors are expected to be generating over three gigawatts of electricity by 2023.

The EC is questioning whether the involvement of the British Government in the project to ensure predictable revenues for EDF for the next thirty five years will violate European Union (EU) rules covering state aid for commercial ventures. The British government could end up providing as much as twenty seven billion dollars to EDF depending on actual capital costs that EDF incurs. EU law says that a member state can give support to a commercial venture only to the extent that that commercial venture could have gotten the same level of support from the marketplace.

The deal between the British government and EDF stipulates that if the future price of electricity drops below the agreed level, the British government will step in and pay EDF the difference. On the other hand, if the price of electricity rises above the market price, EDF will pay the difference to the British government. The British government explains that this will guarantee that the plant operator will "receive a fixed level of revenues and will therefore not be exposed to market risks for the duration of the scheme."

The British government offers the same guarantee to low-carbon energy sources including renewables such as wind and solar. Each type has a set strike price which the government supports. However, nuclear power plants do not have the same sort of blanket guaranteed support. Each nuclear project has to considered individually.

The EC is worried that British governmental support could potentially distort the British energy market and even affect the entire EU energy market. This investigation is timely in that the British government has recently announced plans for a massive build up of nuclear power generation to bring sixteen gigawatts of new nuclear capacity online by 2030. If they provided the same sort of support for all the new reactors that they are planning for the Hinkley Point project, this could have a big impact on the EU energy market. In order to be successful, the investigation will need to have cooperation from all the public and private players involved in Hinkley Point.

In the United States and other nuclear countries, the sort of price support the British are offering EDF for Hinkley Point are being abandoned in favor of letting nuclear power compete in the open energy marketplace. This change is already making conventional investment source reluctant to bet on nuclear given that there is an oil glut in the international market and cheap natural gas is lowering the price of electricity. Even renewable electrical generation such as wind and solar are beginning to beat out nuclear in bids for new generation capacity. I have said it before and I will repeat it. Nuclear power is just not commercially viable.

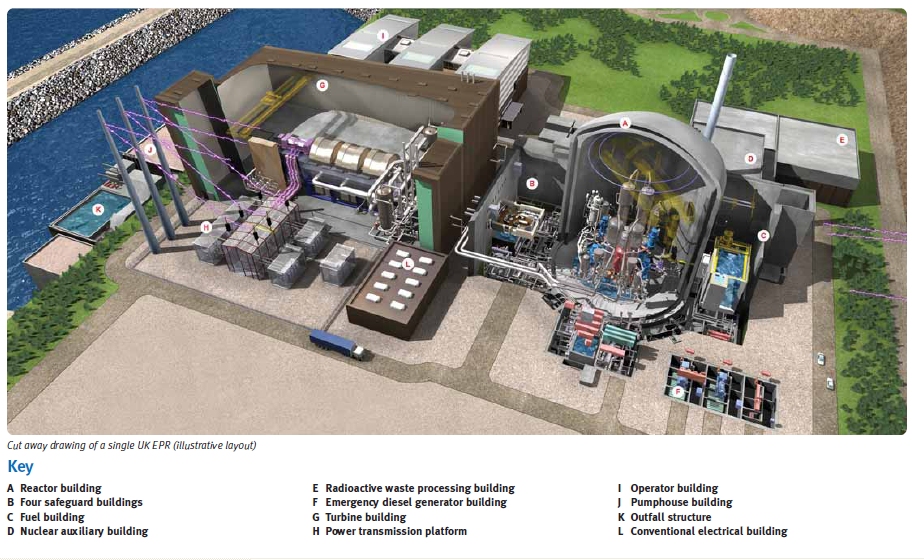

Cutaway drawing of a U.K. ERP reactor: