Part 1 of 3 Parts

Everyone agrees that dealing with the dangerous long-lived radioactive waste generated by nuclear power plants is an urgent global problem. There is a huge backlog of radioactive waste from nuclear power reactors, known as high-level waste. It is in need of safe and permanent disposal. This is a major challenge and it inhibits social acceptance of nuclear energy when the global nuclear industry is presenting itself as essential to addressing the climate crisis. Energy security is also a critical need in a rapidly changing geopolitical landscape.

Although it is complex, nascent and resource intensive, development of deep geological storage sites for spent nuclear fuel and other wastes is currently thought by many to be the future gold standard for disposal. It would also be a boon to the industry in those countries that can claim progress in such approaches to radioactive waste disposal.

Finland is using the construction of ONKALO, a first of its kind deep geological disposal site scheduled to enter operation in 2025 as the basis for significantly increasing the share of nuclear power in its energy portfolio. It claims that these plans are responsible because it is tackling one of the nuclear industry’s major challenges.

In contrast to Finland, there is a stalemate on creating such disposal sites in the U.S. which is currently the biggest produce of nuclear energy in the world. This impediment is hindering a build-out of nuclear power in the U.S. according to a national panel on nuclear waste issues. The U.S. Nuclear Waste Technical Review Board wrote to the U.S. Congress in April of 2021 that “The lack of progress on developing and operating a geological repository… impedes the associated potential benefits of having nuclear energy as part of a zero-carbon future for mitigation of climate change.”

The promise of new technical solutions to the nuclear waste problem remains on the horizon. Emerging issues such as modern nuclear power plant producing even more radioactive waste are further complicating storage and disposal prospects.

Some consider nuclear power critical for decarbonizing economies due to a few key factors.

First, nuclear power plants’ emissions of greenhouse gases and other air pollutants are close to zero during the operating phase. Second, they provide baseload generation of electricity that operates when intermittent renewable energy sources like solar and wind power cannot. Third, they support, rather than compete with, renewable energy sources because those sources are uniquely adapted to changing with demand load.

The International Atomic Energy Agency (IAEA) is the global agency supporting and advocating nuclear power. It recently emphasizes the third point above using 2020 data from nuclear power plants. During the pandemic, electricity demand fluctuated more than usual.

The IAEA said in a report published in June 2021 that “Flexible nuclear power plant operation – or, in some cases, complete short-term shutdowns – supported grid operator needs and demonstrated nuclear power’s ability to integrate into sustainable energy systems of the future.”

The IAEA projects that nuclear generating capacity could double to about eight hundred megawatts by 2050 compared to about four hundred megawatts in 2020. This high-end scenario would require significant action in order to be realized. However, disposal is an issue for the here and now. It is a problem that will only grow more urgent whether capacity reaches low-end or high-end projections.

The international consensus is that high-level radioactive waste should be finally disposed of deep underground in geological sites where it can remain sealed off from the surface and atmosphere well into the distant future. Spent nuclear fuel remains dangerously radioactive for hundreds of thousands of years.

Please read Part 2 next

Blog

-

Radioactive Waste 852 – Problem Of Spent Nuclear Fuel Disposal – Part 1 of 3 Parts

-

Nuclear News Roundup Feb 27, 2022

‘Red light blinking’ at Ukraine nuclear plant, IAEA chief lakegenevanews.net

Finnish regulator approves periodic safety review for Loviisa NPP neimagazine.com

Kim Warns N. Korea Could ‘Preemptively’ Use Nuclear Weapons usnews.com

‘Kim Jong-un-like’ Putin nuclear ‘blackmail’ stimulating weapon proliferation across world express.co.uk

-

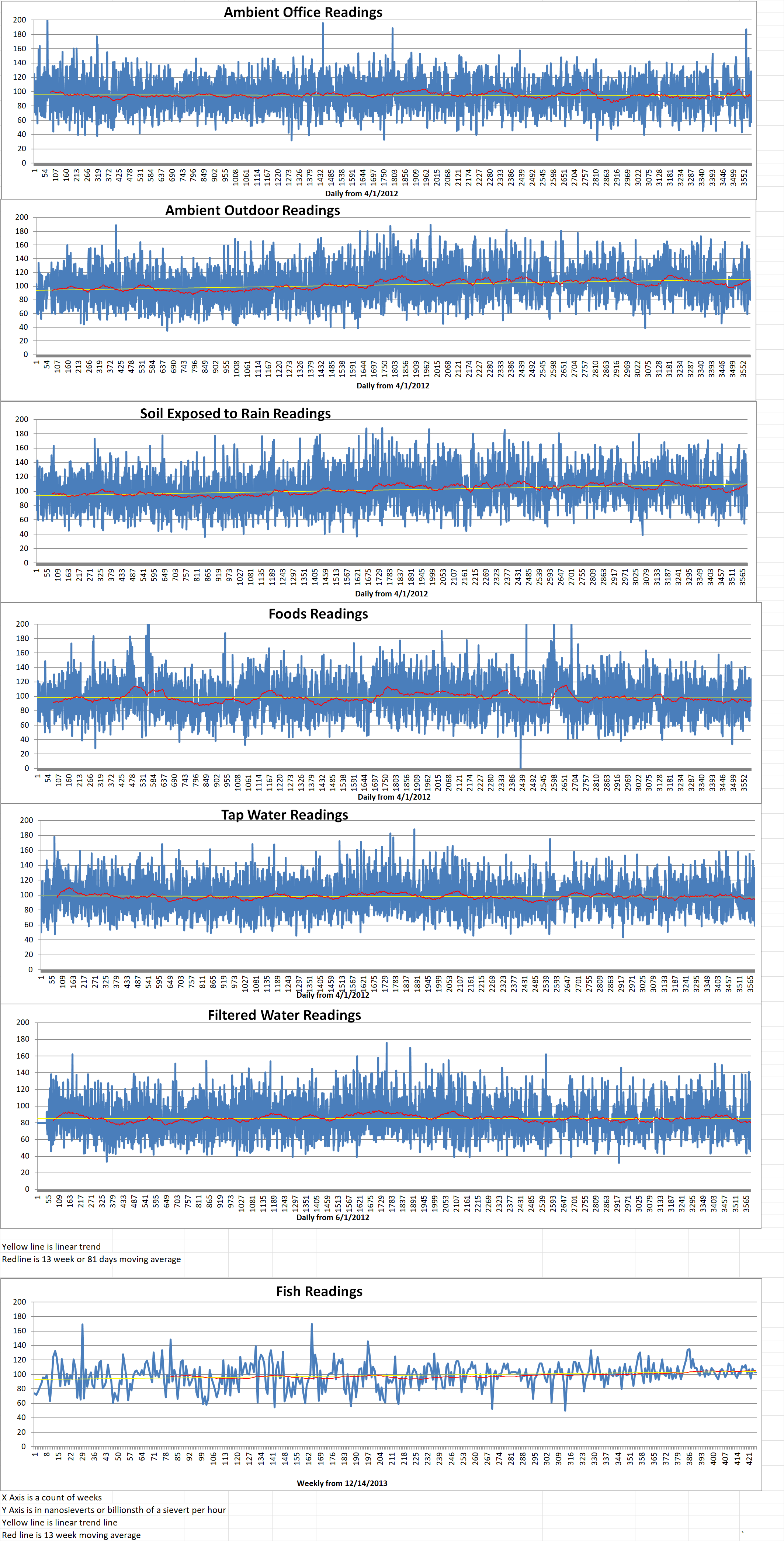

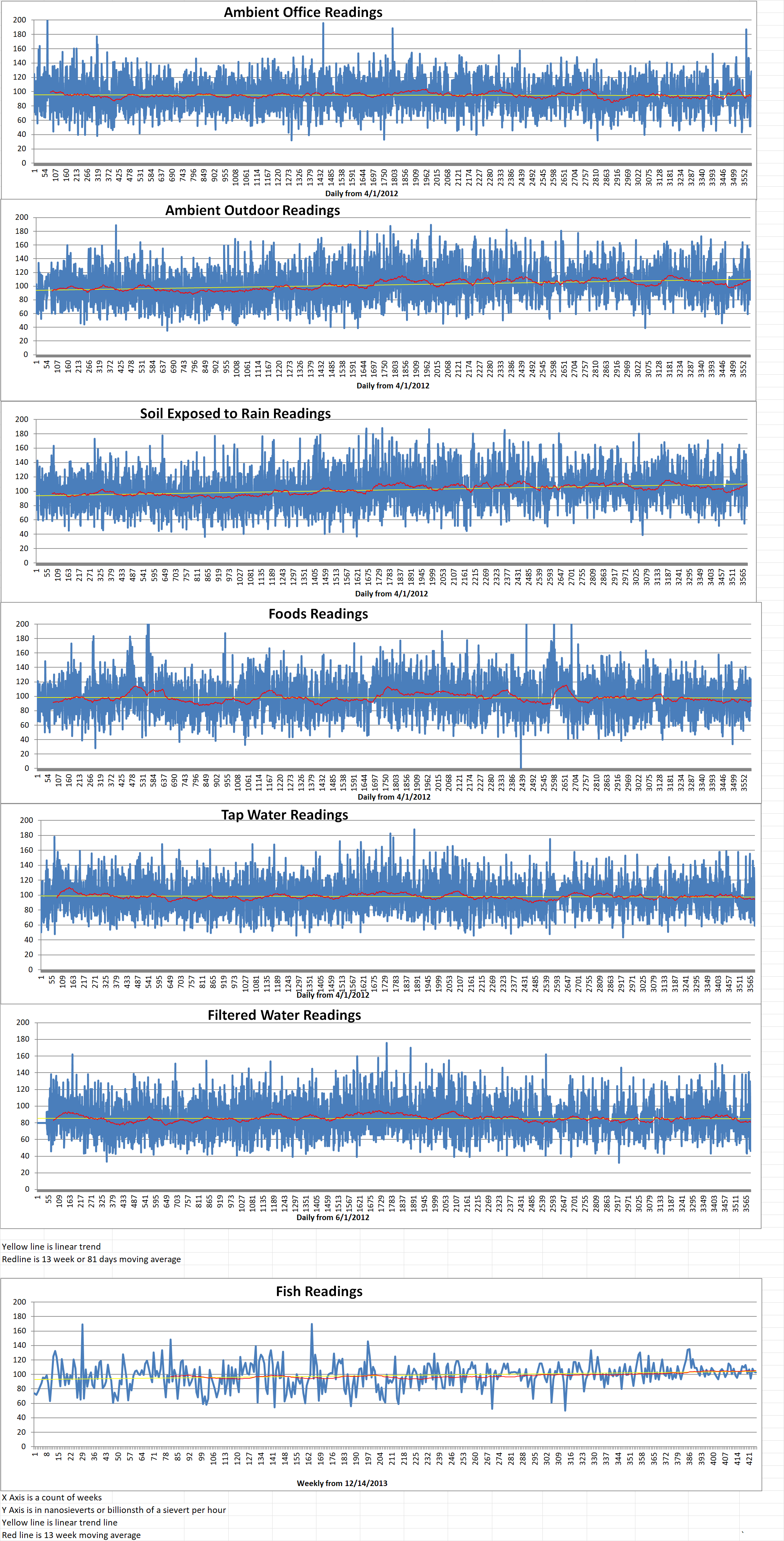

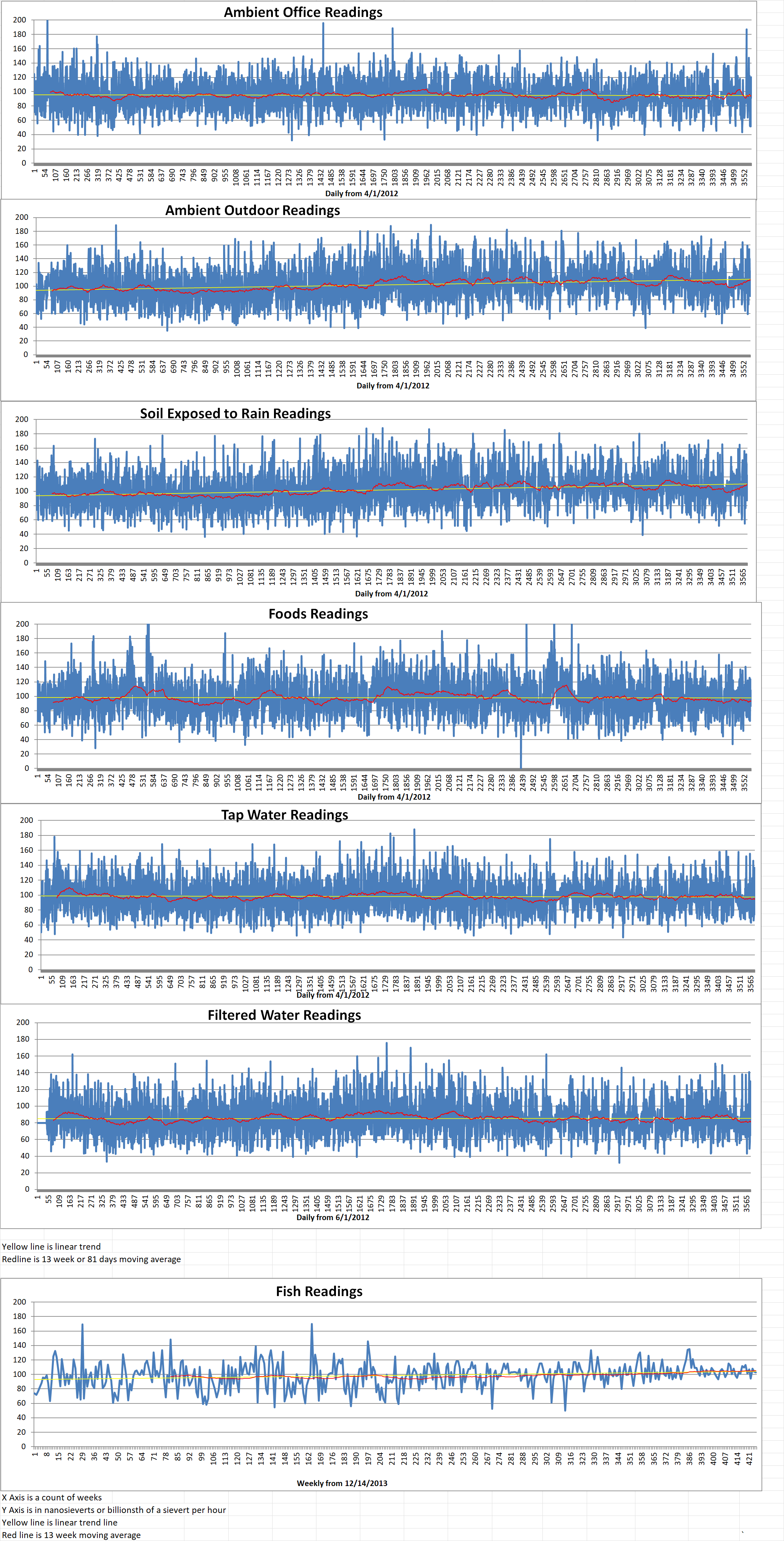

Geiger Readings for Feb 27, 2022

Ambient office = 118 nanosieverts per hour

Ambient outside = 96 nanosieverts per hour

Soil exposed to rain water = 100 nanosieverts per hour

English cucumbers from Central Market = 87 nanosieverts per hour

Tap water = 78 nanosieverts per hour

Filter water = 67 nanosieverts per hour

-

Nuclear Reactors 1019 – World Uranium Market Has Not Been Impacted By Recent Geopolitical Events – Part 2 of 2 Parts

Part 2 of 2 Parts (Please read Part 1 first)

(Continuing comments by Askar Batyrbayev, Chief Commercial Officer of NAC Kazatomprom JSC.)

Batyrbayev said that biggest challenge was transporting uranium. “We started to develop alternative routes that do not use Russia at all.” A three month ban on the transport of Class 7 radioactive materials through St Petersburg was imposed during the 2018 soccer World Cup. It was a trigger point for Kazatomprom to consider other options. There are continuing discussions to transit China.

Batyrbayev said that one appropriate route has already been identified through the Caspian Sea, into the Black Sea and the via the Mediterranean Sea. The first shipment was made to Orano using this route in 2018. There have been seven shipments made to countries around the world utilizing that route since then. He said that transporting uranium via this alternative route is “definitely slightly more expensive” than the previous route across Russia. The Russian route has been used for twenty years. It is shorter and quicker for deliveries to France.

Nicolas Maes, CEO of Orano Mining, said “From the supply perspective, we need to remember that at the moment Canada is operating at 50% of its capacity. We have reduced Niger to 50% of what it produced in the year 2011 and our operations in Kazakhstan are probably still 23-24% below their nameplate capacity.”

Maes went on to say that geopolitical risks and supply chain risks highlight the need for diversity. That has been a key feature of Orano’s operations for some time. He said, “Despite the low-price period and the very difficult situation, we kept progressing with our projects, we kept running the most significant exploration projects and the most significant development projects. As we speak now, we have one pilot ISL project operating in Mongolia, we are building one in Uzbekistan that will be commissioned by the end of the year and we have decided to reshape our Imouraren project in Niger … At the end of 2023, we will have proven technologies at projects in Uzbekistan, Mongolia and Niger”. He added that the decision to make investments will have to be a joint decision between customers, utilities and the nuclear industry.

Cameco President and CEO Tim Gitzel said, “We operate on supply-demand fundamentals. We want good utility customers that will stick with us for 5 to 10 years at conditions that are acceptable to both sides so that we can confidently invest in our operations and run them … What we won’t do is just fire up everything again just to get in the same spot we were before and go through another 10 years of tough time.”

Gitzel went on to say that operations that have been placed in care and maintenance are likely to be the first ones to be restarted “as the market improves and as our customers are calling for and can show to us that they need it, and when we come to an agreement we will start bringing those back on.”

Cameco announced plans in February to begin ramping up production at the McArthur River/Key Lake which had been idle since 2018. Gitzel mentioned that it will probably require eighteen to twenty-four months “to reach the level we want. We are not going to run it at full speed, we say we will run it at about 15 million pounds. We’ve had it has high as 20 million pounds and we’re licensed for 25 million.” He also noted that Cameco could also bring assets back online in Wyoming and Nebraska in the U.S., if market conditions are right.

Batyrbayev said that Kazakh uranium mines are currently operating about twenty percent below capacity. He added that “If we see that the market needs more material, first we can return back to 100% capacity, we can go to 120% [under existing subsoil agreements].” He also said that Kazatomprom is planning to begin commercial operation at a new mine in 2024 which will reach full capacity in 2026. At that time, it will be the biggest ISL mine in the world. The first year of production has already been contracted. -

Nuclear News Roundup Apr 26, 2022

Vermont No Longer Has a Nuclear Power Plant — but Still Uses Nuclear Power sevendaystv.com

Vohra receives $540k grant from U.S. Department of Energy’s National Nuclear Security Administration uab.edu

Doosan to begin forging components for NuScale’s SMRs neimagazine.com

South Korea offers to construct Poland’s first NPP neimagazine.com

-

Geiger Readings for Apr 26, 2022

Ambient office = 128 nanosieverts per hour

Ambient outside = 80 nanosieverts per hour

Soil exposed to rain water = 79 nanosieverts per hour

Avocado from Central Market =123 nanosieverts per hour

Tap water = 59 nanosieverts per hour

Filter water = 46 nanosieverts per hour

-

Nuclear Reactors 1018 – World Uranium Market Has Not Been Impacted By Recent Geopolitical Events – Part 1 of 2 Parts

Part 1 of 2 Parts

The World Nuclear Fuel Conference 2022 was just held in London. Recent geopolitical events have not yet impacted the global uranium market according to speakers from uranium suppliers. They agreed that the longer-term future of the uranium market is uncertain.

Treva Klingbiel is the president of TradeTech. He said, “We face an unprecedented time ahead of us. We face both incredible challenges and opportunities given where we are in the marketplace, both with the need for new nuclear and the expectations and realization that we need it and we face a supply deficit. And also on top of that, we have outsized geopolitical events that are really overshadowing and can impact much of the nuclear fuel cycle.”

Tim Gitzel is the president and CEO of Cameco. He noted that the nuclear disaster in 2011 in Fukushima, Japan “changed our lives.” He mentioned that Cameco was continuing to produce uranium even in the face of a drop in demand. “It took Cameco five years to realize we got to do something different than we had been doing and so, with our partners, we decided to pull back on some production and shut Rabbit Lake down. We shut Wyoming down, we shut Nebraska down and we pulled back on McArthur River. The last 60 days has been unbelievable. We are still trying to figure it out.”

Nicolas Maes is the CEO of Orano Mining. He pointed out that from the supply and demand perspective, the fundamentals had not really changed. He said, “The consumption by reactors hasn’t changed. And it’s not because the financial community came and played on our market.” He went on to say that the geopolitical tensioins have come at a time when production has been reduced. He added that “We obviously have in mind what is happening at the moment in Ukraine, but geopolitics have been there in our market on a much larger scale and have been for a while.”

Maes went on to discuss how nuclear fuel is a very small part of the overall financial equation in tensions between countries. He said that it is not likely that geopolitical tensions between nations will lead to sanctions being taken with respect to the nuclear market “because of the small impact on financial markets. The worldwide market for uranium is worth about USD9 billion annually, which is equivalent to a few days of sales for the top oil companies. It is a relatively small market.”

Askar Batyrbayev is the Chief Commercial Officer of NAC Kazatomprom JSC. He said that “We all want to see the same actions on the market. We would like it to be stable, predictable and reliable for all market participants.” He mentioned that the COVID-19 pandemic brought many uncertainties and challenges for Kazakhstan’s uranium industry. In addition to those problems, the country faced civil unrest in January of this year. “But we came out of that situation very rapidly. All operations were sustained and were reliable, so nothing has changed, which now added with events in Ukraine, the market was already becoming very tight and it is hard to predict where it can go, how much more uranium we will need, what sort of restrictions will be there.”

When he as asked about his concerns over security of supply and Russian involvement in Kazakh uranium projects, Batyrbayev said that Rosatom has so far been excluded from any sanctions. “In terms of that, there have been no disruptions in operations. We have five joint ventures with the Rosatom group. All of them are operating normally.” However, he said that Kazatomprom is taking measures to deal with the possibility of future sanctions that could impact production.

Please read Part 2 Next -

Nuclear News Roundup Apr 25, 2022

Idaho Nuclear Waste Treatment Plant Hit With More Problems usnews.com

Kremlin escalates rhetoric and claims Ukraine is developing nuclear weapons foxnews.com

Zelenskyy says Russian missiles flew over nuclear plants on anniversary of Chernobyl usatoday.com

PNC shareholders defeat proposal on nuclear weapons lending for second time post-gazette.com

-

Geiger Readings for Apr 25, 2022

Ambient office = 120 nanosieverts per hour

Ambient outside = 92 nanosieverts per hour

Soil exposed to rain water = 95 nanosieverts per hour

Russett potato from Central Market = 87 nanosieverts per hour

Tap water = 77 nanosieverts per hour

Filter water = 70 nanosieverts per hour

-

Nuclear News Roundup Apr 24, 2022

In Response to Lavrov Comments, U.S. Says Talk of Nuclear Escalation Is Irresponsible usnews.com

North Korea shows off apparent new solid fuel missile nknews.org

Korea offers six reactors to Poland world-nuclear-news.org

Sixth Hongyanhe unit achieves first criticality world-nuclear-news.org