Australia mines and exports uranium. However, so far Australia has rejected nuclear power inside its own borders.

A great deal of the debate about nuclear power in Australia during the month since the Coalition announced its plan to install nuclear reactors in seven states has been about cost. (The Liberal–National Coalition, commonly known simply as the Coalition or the LNP, is an alliance of center-right to right-wing political parties that forms one of the two major groupings in Australian federal politics.)

However, some things matter more to electricity users than the average price they pay for electricity. For big industrial consumers who either buy their power wholesale, or renegotiate their fixed-term price contracts frequently, it is critical that the wholesale price remains fairly steady.

Nuclear power plants produce power at a fairly steady pace. This leads to a more steady market price. Power systems built around wind and solar produce cheaper power. However, wind and solar have more uncertain output and much greater variability in price.

This greater variability can be reduced to some extent by adding storage such as pumped hydro and large-scale batteries. However, to the extent that it remains, uncertain prices make investments in power-hungry projects harder to justify. The bigger the uncertainty, the more investment moves to other firms, other less energy-intensive industries and other countries. This trend has been confirmed in a study of the behavior of thousands of Chinese firms between 2008 and 2018.

The preliminary results from a project using data from Queensland were presented during Australian Energy Week last month. These results suggest that higher volatility in wholesale electricity prices reduces the share price of listed firms in the metals and mining industries. Intraday price volatility has increased by a factor of two over the past five to ten years. This has cost the companies that suffered it five percent of their share market value.

The metals and mining industries are assessed at about twenty-seven billion dollars, meaning a five percent reduction in share price corresponds to fifty dollars each year.

Since nuclear power can generate electricity regardless of the weather or time of day, an advantage it has is lower price volatility. This can be seen by investigating what has happened in other countries when a sizeable proportion of the nuclear capacity has been taken offline. Here are two examples.

The first example is from Germany which shut down three nuclear reactors on December 31, 2021. This cut Germany’s nuclear power capacity in half overnight. Shutting down the reactors pushed up price volatility by five percent to fifteen percent.

The second example is from France. There, stress corrosion cracking was discovered in several reactors and in April 2022, it had shut down twenty-eight of France’s fifty-six reactors. This resulted in France experiencing a few extreme price spikes, which also drove up the volatility.

In nearby southern Sweden and Poland, price volatility fell ten percent to twenty five percent during the same period.

As wind and solar installations keep expanding across the globe, it is highly likely that electricity wholesale price volatility will climb further. If Australia continues to refuse nuclear power, it important to ask what else it can do to keep price volatility in check.

Blog

-

Nuclear Reactors 1414 – Price Volatility In Australian Energy Market

-

Nuclear News Roundup Aug 05, 2024

Nuclear Regulatory Committee shares updates on Palisades Power Plant restart wsbt.com

Oak Ridge nuclear reactor Hermes is under construction to ‘transform our energy landscape’ knoxnews.com

DoD ‘exploring’ options for nuclear buildup as part of strategic review breakingdefense.com

Negotiator of 2015 nuclear deal named Iran VP france24.com

-

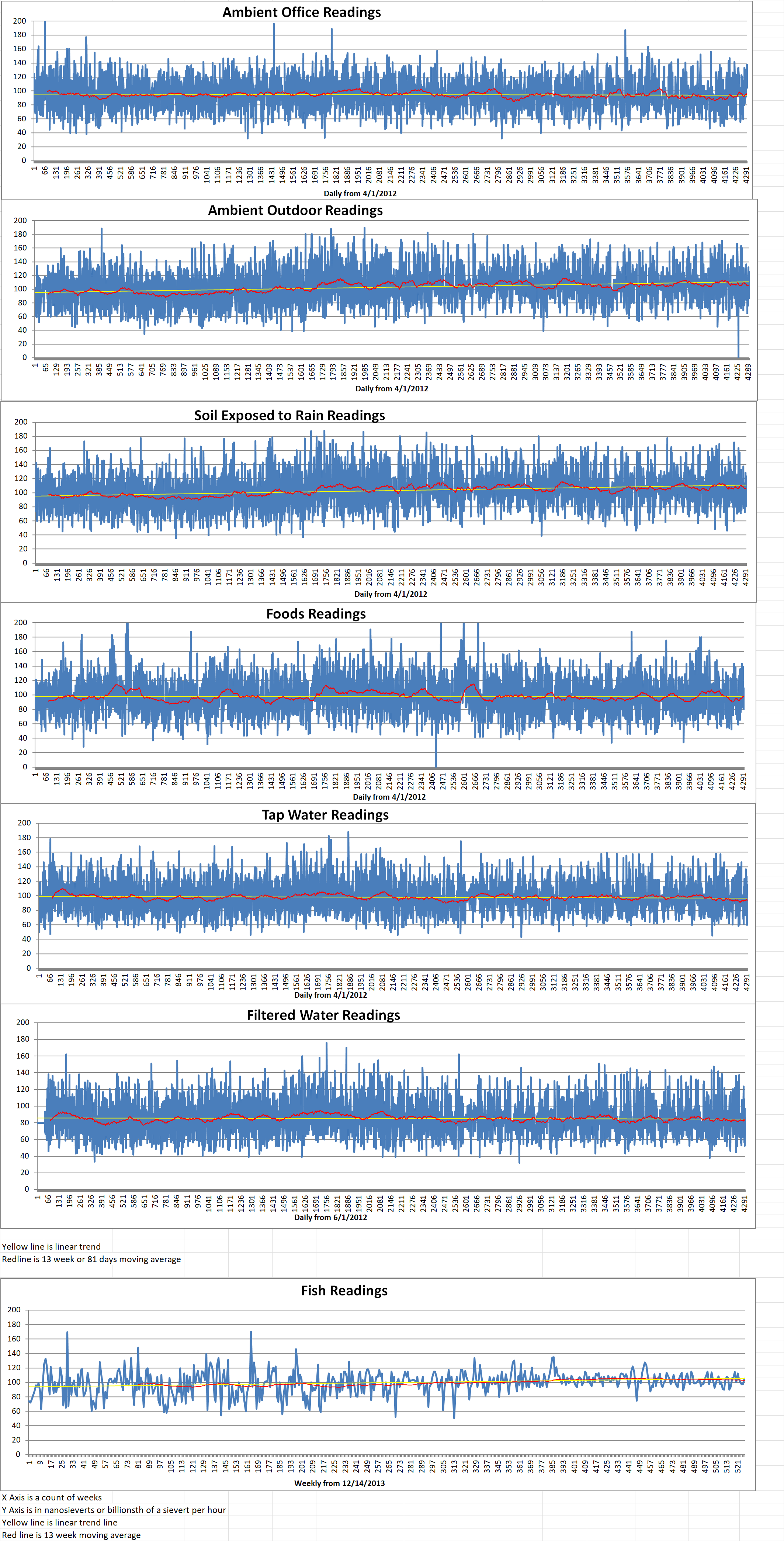

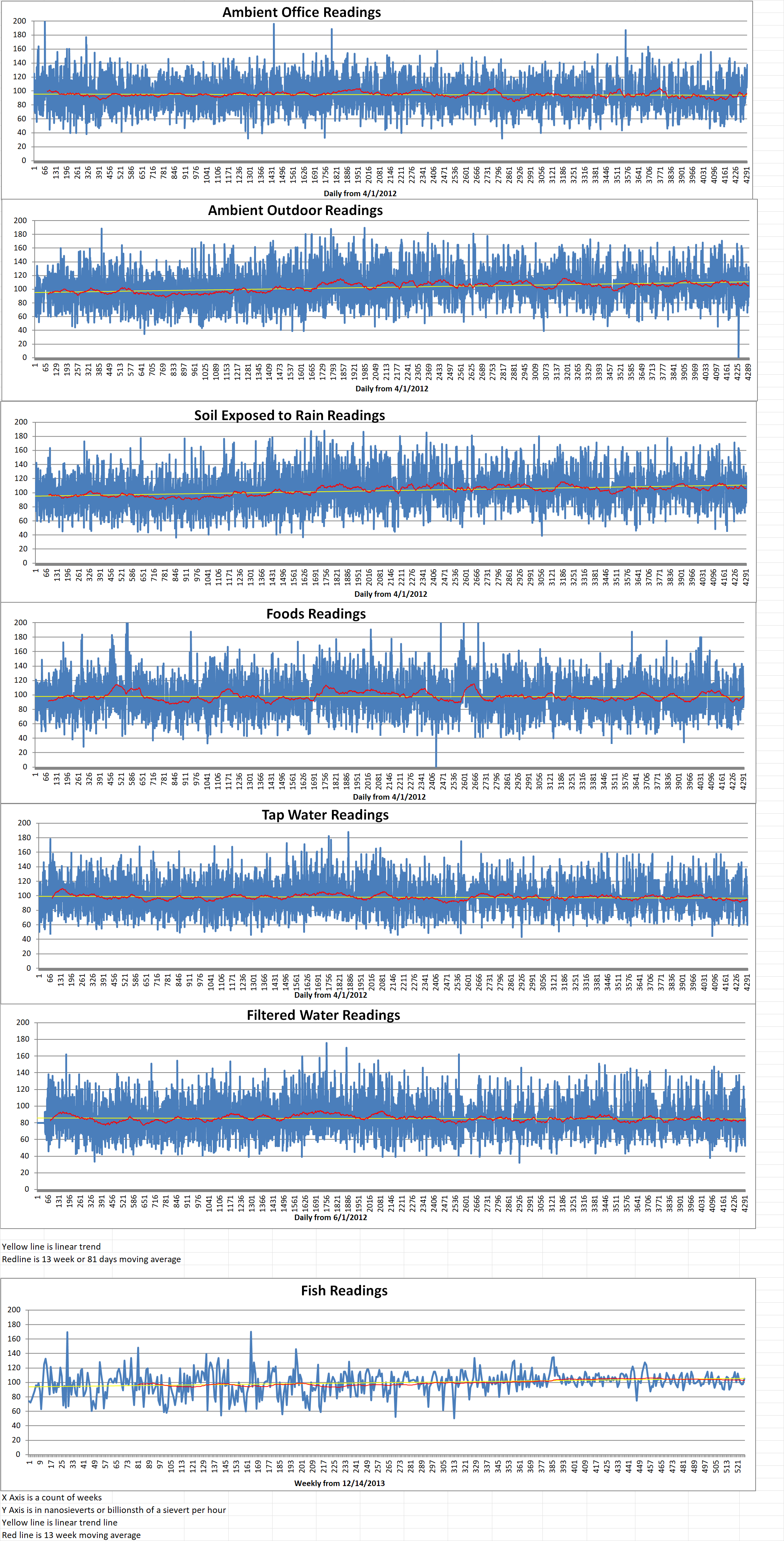

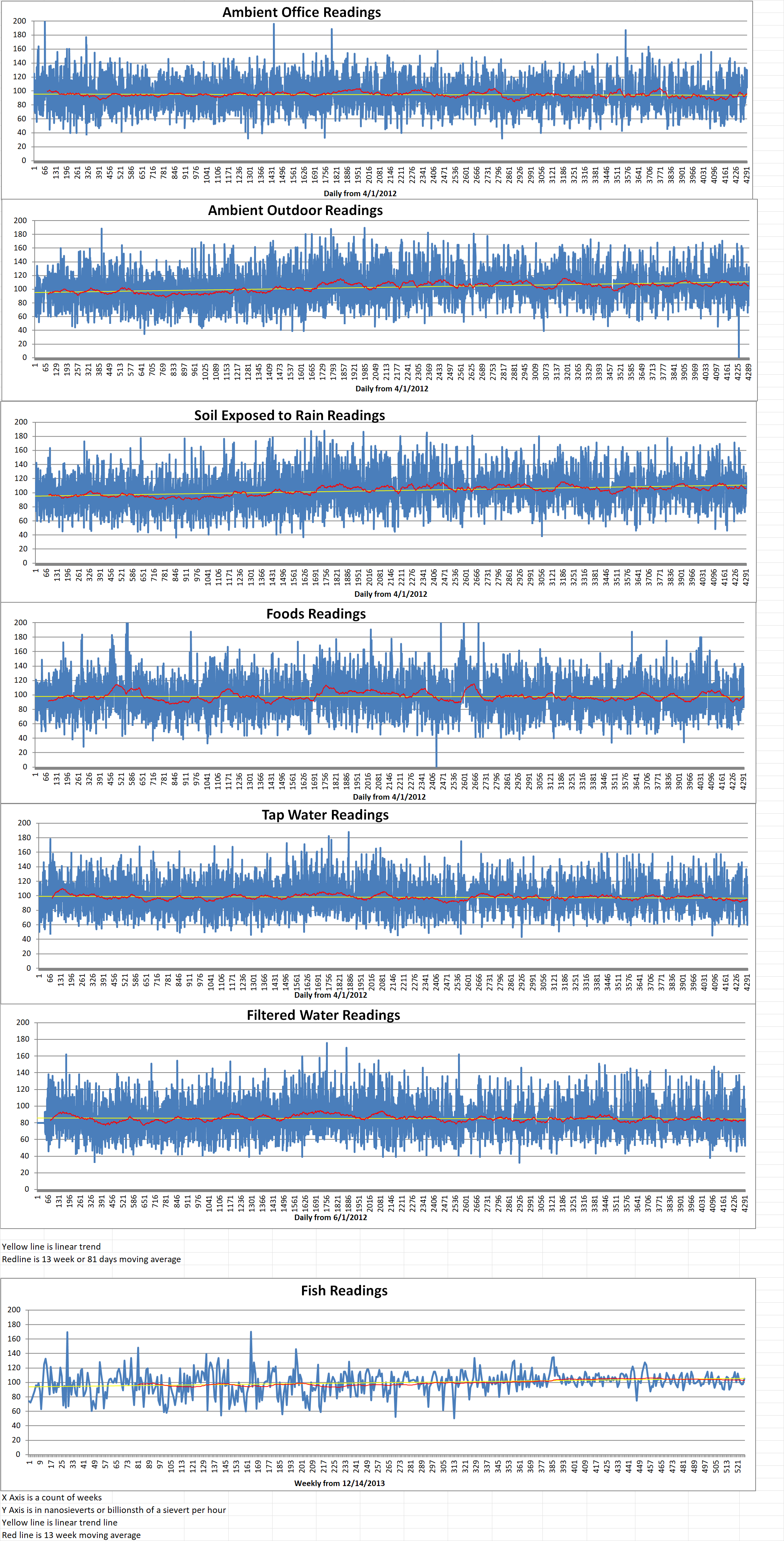

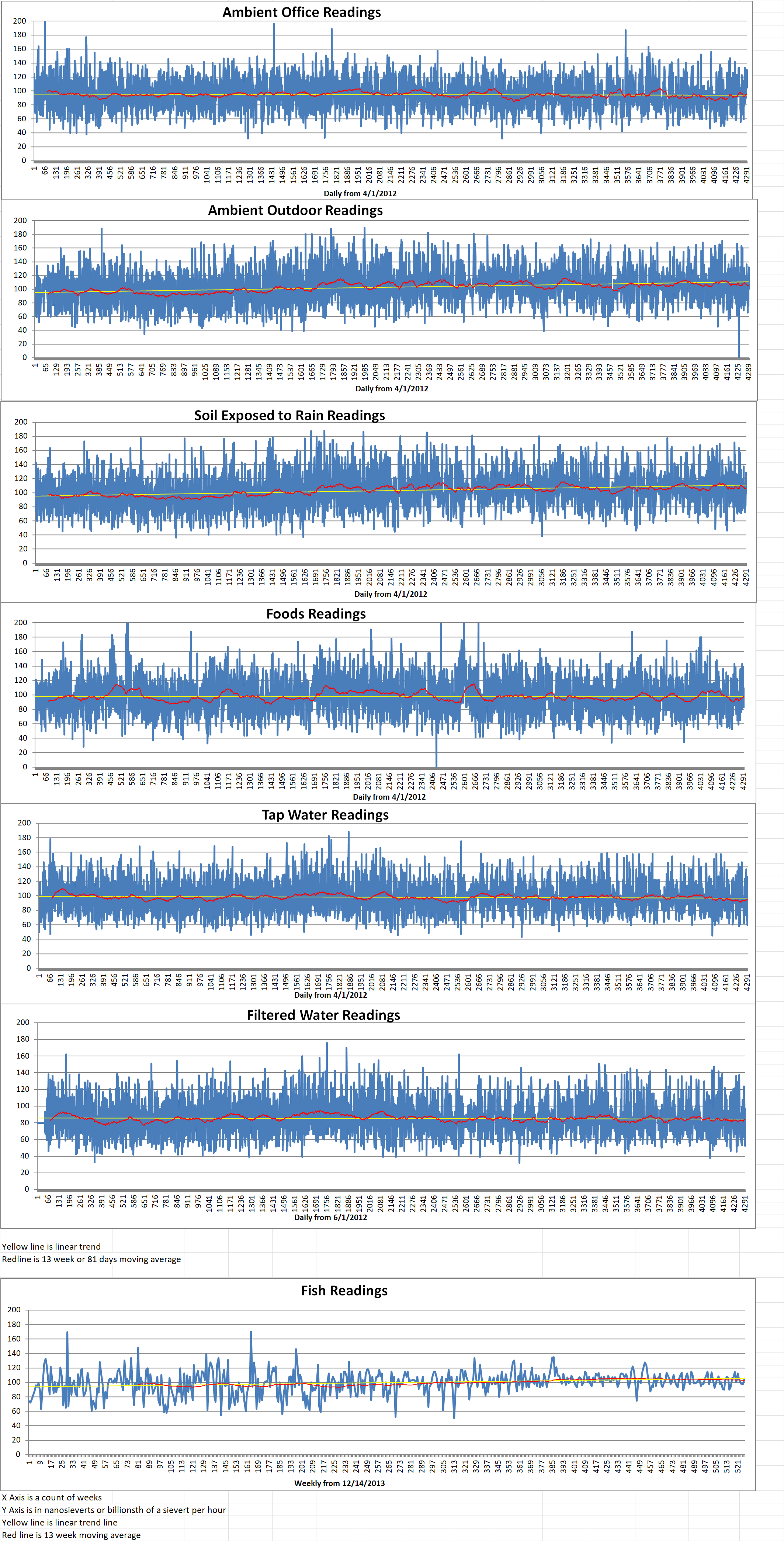

Geiger Readings for Aug 05, 2024

Ambient office = 105 nanosieverts per hour

Ambient outside = 87 nanosieverts per hour

Soil exposed to rain water = 81 nanosieverts per hour

Tomato from Central Market = 80 nanosieverts per hour

Tap water = 75 nanosieverts per hour

Filter water = 67 nanosieverts per hour

-

Nuclear News Roundup Aug 04, 2024

Japan’s nuclear authority decides to reject plan to restart Tsuruga No.2 reactor www3.nhk.or.jp

Vistra Receives Approval to Operate Comanche Peak Nuclear Plant Through 2053 prnewswire.com

Russian Forces Test Installing Dummy Warheads as Part of Nuclear Drills usnews.com

Pentagon plans new nuclear warheads, launchers amid Russia, China threats interestingengineering.com

-

Geiger Readings for Aug 04, 2024

Ambient office = 138 nanosieverts per hour

Ambient outside = 89 nanosieverts per hour

Soil exposed to rain water = 86 nanosieverts per hour

Seranos pepper from Central Market = 97 nanosieverts per hour

Tap water = 100 nanosieverts per hour

Filter water = 86 nanosieverts per hour

-

Nuclear News Roundup Aug 03, 2024

US must expand nuclear arsenal in face of Russia and China threat, warns top Obama defense adviser foxnews.com

Ukraine needs to increase nuclear power capacity to overcome problems with electricity generation, US official says energycentral.com

The Congressional Nuclear Bunker Is for Sale Because of a Defaulted Loan gizmodo.com

‘Ontario’s moment:’ Minister says Canada building blueprint for nuclear energy future cp24.com

-

Geiger Readings for Aug 03, 2024

Ambient office = 130 nanosieverts per hour

Ambient outside = 111 nanosieverts per hour

Soil exposed to rain water = 109 nanosieverts per hour

Red bell pepper from Central Market = 109 nanosieverts per hour

Tap water = 89 nanosieverts per hour

Filter water = 69 nanosieverts per hour

Dover Sole = 99 nanosieverts per hour

-

Nuclear Reactors 1411 – Niger Has Revoked Orano’s License To Mine Uranium

Niger has revoked the operating license of French nuclear fuel producer Orano at one of the world’s biggest uranium mines. This is a move that highlights tensions between France and the African country’s ruling junta.

Orano announced it that has been excluded from the Imouraren mine in northern Niger. This mine sits on an estimated two hundred thousand tons of the uranium, used for nuclear power and weapons.

Mining was supposed to have started at Imouraren in 2015 but development was frozen after the collapse in world uranium prices caused by the 2011 Japanese nuclear disaster.

The Niger government did not immediately comment on the company’s announcement. It had vowed to review mining concessions in the country. The mining ministry had warned that it would take away Orano’s license if development work had not started by June 19.

A week before the deadline, Orano said that “preparatory work” had recently started at Imouraren.

The company said in a statement Thursday that “Orano takes note of the decision by the Niger authorities to withdraw from its subsidiary Imouraren SA its license to work the deposit.”

It added that the Niger’s move came despite its recent resumption of “activities” at the site. It said its actions had been fulfilled in line with the government’s wishes.

Orano stated that it was “prepared to keep open all channels of communication with the Niger authorities on this subject, while reserving the right to contest the decision to withdraw the mining license in the national or international courts”.

Orano added that mine infrastructure had reopened from June 4 and dozens of people were involved “to make progress with the work”. It said Imouraren would eventually provide jobs for eight hundred people on the project, including subcontractors.

The French firm has been active in Niger since 1971. A uranium mine at Arkokan has been closed since 2021. However, Orano runs another uranium mine in the northern region of Arlit despite what it calls “logistical” difficulties.

Niger is landlocked. Its border with Benin, its main sea access, is closed. The government claims that this is for “security” reasons. The closure is an obstacle to exports of Niger’s minerals.

Niger in 2022 accounted for about a quarter of the natural uranium supplied to European nuclear power plants. This is according to data from the atomic organization Euratom. Kazakhstan is Europe’s main supplier, ahead of Niger and then Canada.

The military junta in Niger vowed to review foreign mining concessions in the country after it took power in July last year. The military rulers have also turned against France. They have ordered French troops based in the Niger to leave and increased criticism of the former colonial power. Niger has increasingly reached out to Russia and Iran for support.

Chinese, Australian, US, British, Italian, Canadian, Russian and Indian firms have secured uranium mining licenses in Niger in recent years. As of 2022 there were thirty one prospecting permits and eleven mining licenses.

The Azelik mining company is majority held by Chinese interests. It is increasingly taking over uranium mining in the north of Niger that have been suspended for the past decade because of poor profitability. -

Nuclear News Roundup Aug 02, 2024

Pentagon Official: Alliances Are Key to U.S. Nuclear Deterrence Advantage 315aw.afrc.af.mil

Graham proposes use of military force to stop Iran nuclear breakout politico.com

What is in Putin’s ‘nuclear doctrine’ that could trigger a Russian attack? Independent.co.uk

Talen Energy Offers up Nuclear-Powered Crypto Mining Campus Stake, Sources Say money.usnews.com

-

Geiger Readings for Aug 02, 2024

Ambient office = 120 nanosieverts per hour

Ambient outside = 126 nanosieverts per hour

Soil exposed to rain water = 123 nanosieverts per hour

Mini cucumber from Central Market = 109 nanosieverts per hour

Tap water = 60 nanosieverts per hour

Filter water = 52 nanosieverts per hour