Australian attitudes towards energy sources have shifted significantly according to the 20th edition of the Lowy Institute’s annual poll. Six in ten Australian are now supportive of Australia using nuclear power to generate electricity.

Ryan Neelam is the Director of Public Opinion and Foreign Policy at the Lowy Institute. The Institute asked Australian citizens, “Do you support or oppose Australia using nuclear power to generate electricity, alongside other sources of energy?”

Sixty one percent of respondents said they were “somewhat” or “strongly” supportive of Australia using nuclear power to generate electricity. Thirty seven percent said they opposed this. Only 2% said they didn’t know.

This is the first time such a question has been included in the survey. It contrasts with a related question in the 2011 poll when more than six in ten Australians said they were either ‘strongly against’ or ‘somewhat against’ Australia building nuclear power plants as part of its plans to reduce greenhouse gas emissions.

Australia’s federal opposition has announced that, if elected, it would introduce nuclear power generation into Australia’s energy mix. Nuclear would take its place alongside renewables and other sources of energy, as part of its plan to achieve net zero emissions by 2050, but this would involve first overturning a moratorium on nuclear energy generation in Australia, the report’s authors note.

The poll found ‘slim to strong majority support’ for a range of potential federal government climate-related policies although support has ‘softened mildly’ for options which include a more ambitious national emissions reduction target, hosting a UN climate conference, reducing coal exports, and banning new coal mines, and introducing an emissions trading scheme. About sixty percent support the idea of reducing Australian coal exports and banning new coal mines from opening in Australia.

Support remained steady for subsidizing renewable technologies, and increasing the use of gas. Opinion on renewables is divided. The poll found that forty one percent think the current federal government’s national target for eighty two percent of Australia’s electricity to be generated from renewables by 2030 is ‘about right’. Thirty three percent think this target is too ambitious, and twenty five percent say it is not ambitious enough.

For the third consecutive year, the poll also asked about public attitudes to Australia’s acquisition of nuclear-powered submarines under the 2021 trilateral AUKUS partnership between Australia, the U.K. and the U.S. Public debate about this project has grown in Australia, highlighting questions around its strategic merits, future U.S. political commitment to the deal, industrial and workforce capacity, and costs. However the poll found majority public support for the acquisition has ‘held relatively firm’ with sixty five percent of Australians remaining in favor. This is similar to the findings of last year’s poll, which was down from seventy percent in 2022’s poll, shortly after the deal was announced.

The independent, nonpartisan international policy think-tank describes its annual poll as the leading tracking survey on Australian foreign policy. It provides a reliable vehicle for understanding Australian attitudes towards a wide range of foreign policy issues, while being independent and methodologically rigorous. The 2024 Lowy Institute poll reports the results of a national survey of 2028 adults across Australia between 4 and 17 March. The poll was conducted by the Social Research Centre, using the Life in Australia probability-based online panel, and has a margin of error of two and two tenths’ percent. The probability basis of the Life in Australia sampling method guarantees results are generalizable to the national population.

Blog

-

Nuclear Reactors 1403 – Lowy Institute Sponsors Annual Polls In Australia About Public Attitudes Towards Nuclear Power

-

Nuclear News Roundup Jun 11, 2024

Congress passes sweeping pro-nuclear energy bill yahoo.com

Powering the Permian: Proposed nuclear waste facility sparks backlash from Basin residents yourbasin.com

Putin Once Tried to Curb North Korea’s Nuclear Program. That’s Now Over. Nytimes.com

First fuel delivered for new Kursk nuclear power plant world-nuclear-news.org

-

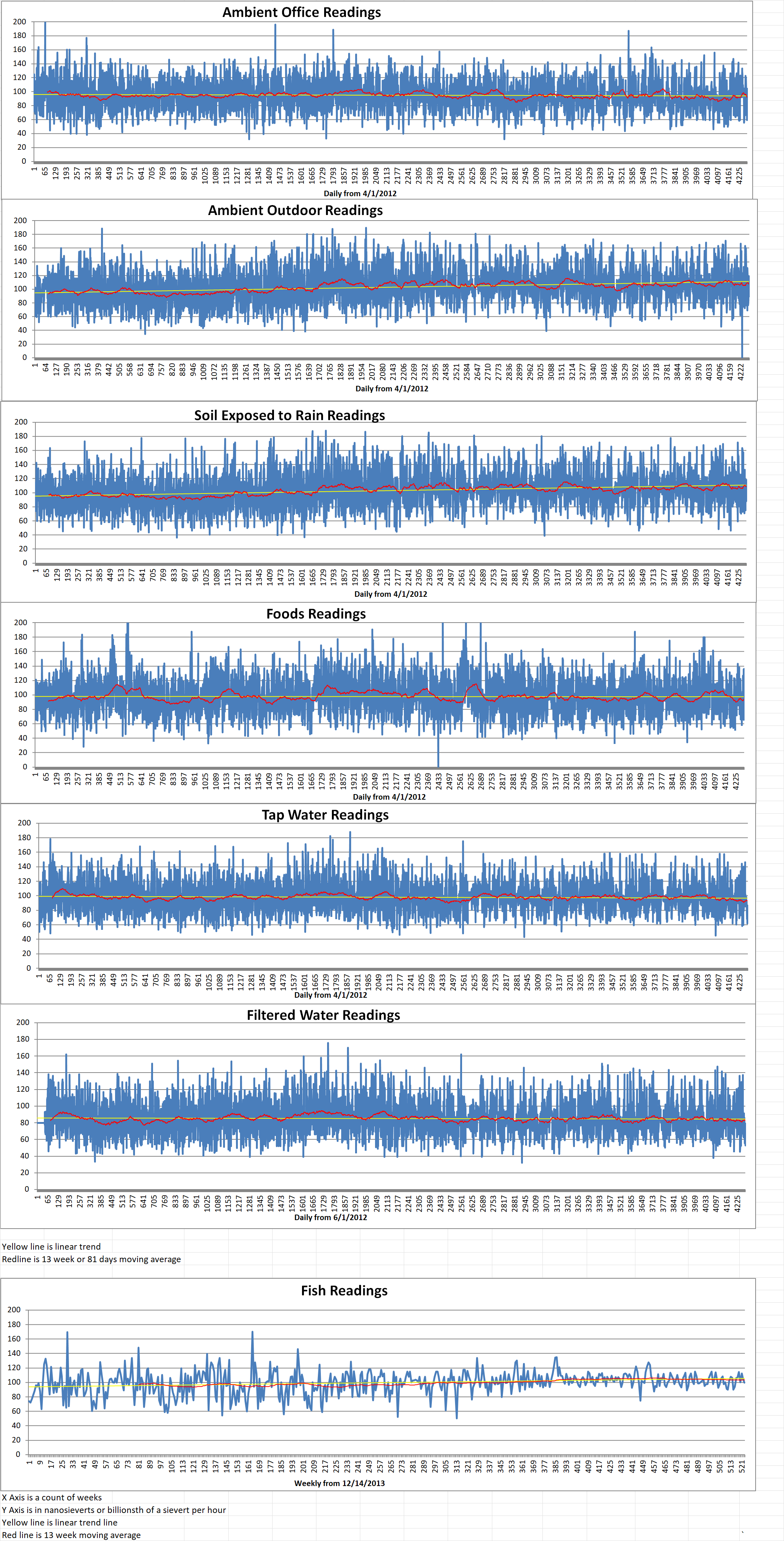

Geiger Readings for Jun 11, 2024

Ambient office = 59 nanosieverts per hour

Ambient outside = 89 nanosieverts per hour

Soil exposed to rain water = 88 nanosieverts per hour

Green onion from Central Market = 65 nanosieverts per hour

Tap water = 62 nanosieverts per hour

Filter water = 58 nanosieverts per hour

-

Nuclear Reactors 1402 – Thorizon Is Collaborating With EDF To Develop A Molten Salt Reactor Utilizing Thorium

Thorizon of the Netherlands has signed a cooperation agreement with France’s EDF R&D to collaborate on the Horizon One molten salt reactor design.

Thorizon is a spin-off from the Nuclear Research and Consultancy Group (NRC), which operates the High Flux Reactor in Petten. The company is developing a two hundred and fifty megawatt thermal/one hundred-megawatt electricity molten salt reactor (MSR), targeted at large industrial customers and utilities. Thorizon plans to construct a pilot reactor system before 2035.

MSRs use low pressure molten fluoride salts as primary coolant. They can operate with epithermal or fast neutron spectrums, and with a variety of fuels. A great deal of the interest today in reviving the MSR concept relates to using thorium (to breed fissile uranium-233). An initial source of fissile material such as plutonium-239 needs to be provided. There are several different MSR design concepts, and a variety of interesting challenges in the commercialization of many, especially with thorium.

The molten salt fuel adopted by Thorizon utilizes a combination of long-lived elements from reprocessed spent nuclear fuel and thorium. The reactor will be able to recycle long-lived spent nuclear fuel from existing nuclear facilities. The Thorizon One concept is unique. The core is composed of a set of cartridges that is replaced every five to ten years. This, the company says, overcomes two molten salt design obstacles which are material corrosion and handling of spent nuclear fuel volumes.

Under the new agreement, EDF R&D will review Thorizon’s neutronic core calculations. They will also conduct scenario analyses to determine how the Thorizon One could help to close the fuel cycle in the European reactor fleet.

Thorizon stated that it will “benefit from EDF’s expertise as the French leader in electricity production, and in particular from the recognized skills of its R&D researchers”.

Bernard Salha is the EDF R&D Director and EDF Group Chief Technical Officer. He said, “The R&D team covers all disciplines from neutronics and fuel to safety and construction. We are actively supporting several start-ups in the France 2030 program. The cartridge-based approach of Thorizon is interesting and promising.”Kiki Lauwers is the Thorizon CEO. She said, “It is a pleasure to work with the EDF team which has more experience in nuclear than any company across the globe. Thanks to EDF R&D, start-ups like us benefit from access to unique industry experts that can very quickly spot the strengths and areas for improvements in our design. We hope we can continue to work with the EDF R&D team on the realization of our technology in the future. We believe all solutions are needed to empower the energy transition and the Thorizon One can be a great compliment to the existing and planned nuclear fleet.”

Horizon added that its ambition is to develop an MSR “that can be realized rapidly and smartly, is ‘walk-away’ safe, and takes a first step towards circularity by using long-lived nuclear waste as a fuel source”. The company intends to build a non-nuclear molten salt demonstrator in the short-term and finalize the detailed design to start constructing a first-of-a-kind Thorizon One reactor by 2030. -

Nuclear News Roundup Jun 10, 2024

Iran Denounces E3 Criticism of Nuclear Program themedialine.org

Ukraine strikes Russia despite nuclear fears vaticannews.va

Shine Technologies, Zeno Power to recycle, reuse spent nuclear fuel auntminnie.com

South Korea seeks site for underground research facility world-nuclear-news.org

-

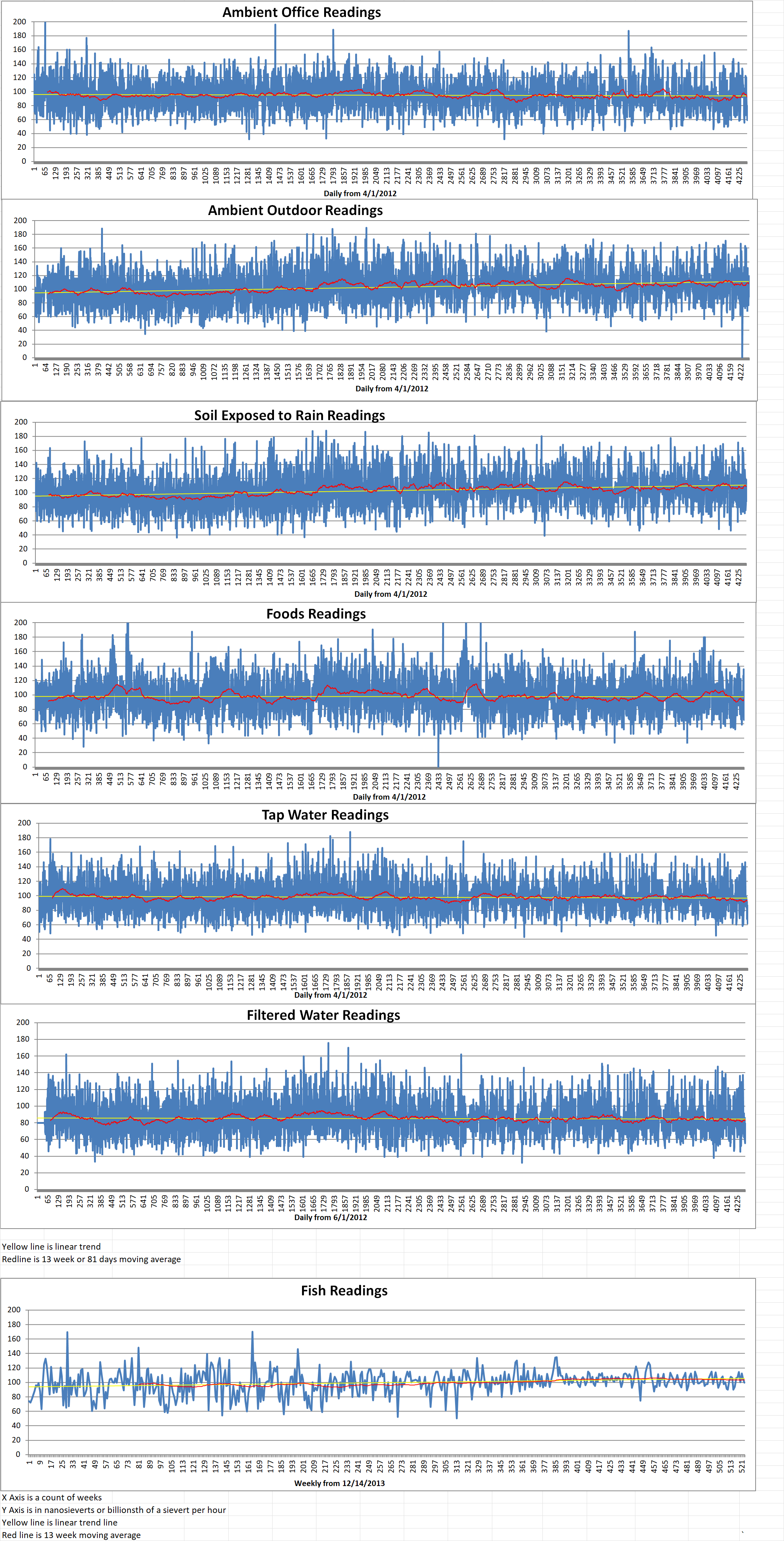

Geiger Readings for Jun 10, 2024

Ambient office = 73 nanosieverts per hour

Ambient outside = 119 nanosieverts per hour

Soil exposed to rain water = 119 nanosieverts per hour

Ginger root from Central Market = 135 nanosieverts per hour

Tap water = 87 nanosieverts per hour

Filter water = 79 nanosieverts per hour

-

Nuclear News Roundup Jun 09, 2024

Spending on nuclear weapons hit $91.4 billion in 2023, watchdog finds voanews.com

Israel to upgrade plutonium in Dimona nuclear reactor – report jpost.com

US, Israel examining new information about Iran’s suspected nuclear activity jpost.com

At China’s First CAP1000 Nuclear Plant, Revolutionary Containment Takes Shape nucnet.org

-

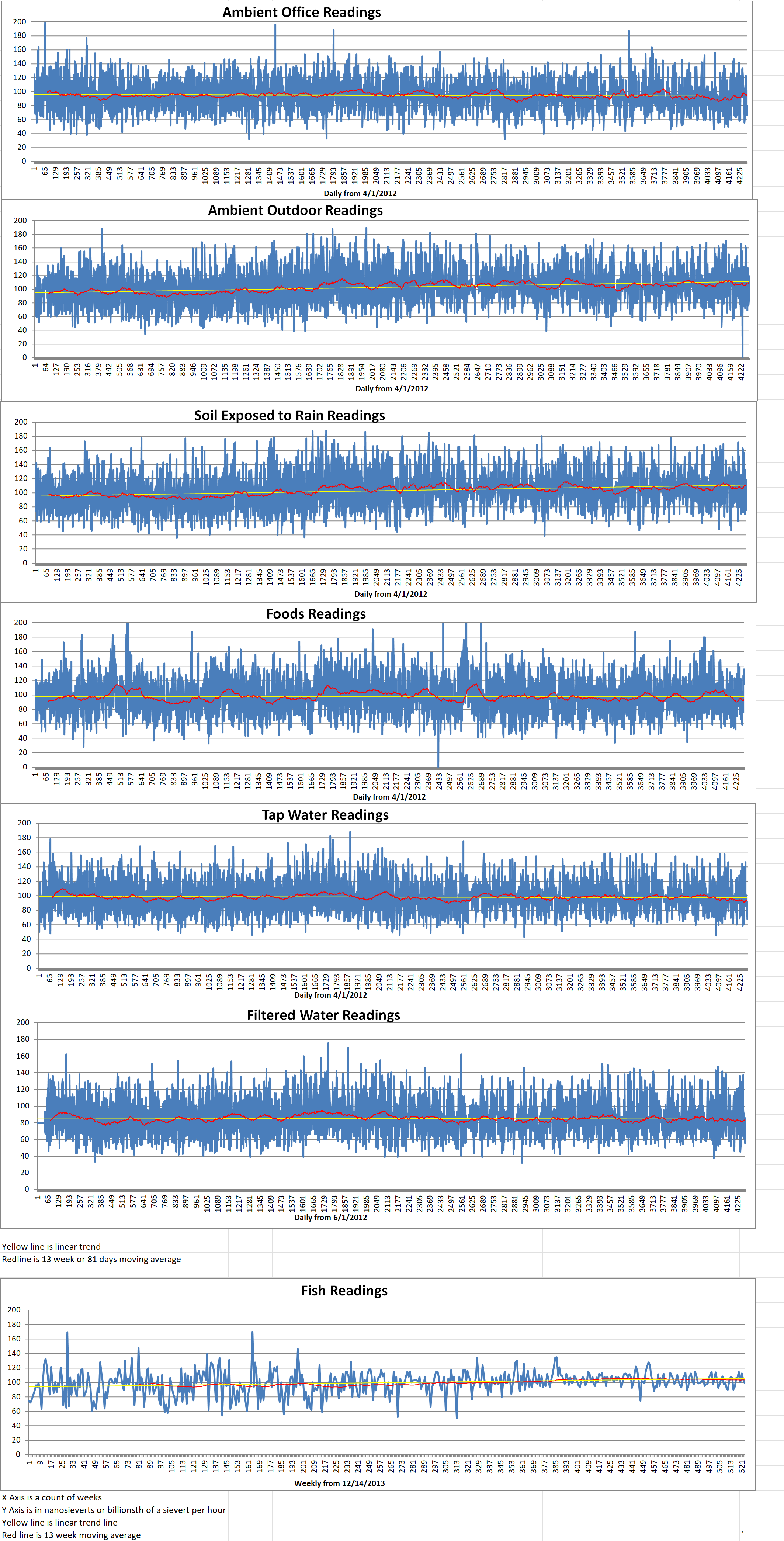

Geiger Readings for Jun 09, 2024

Ambient office = 80 nanosieverts per hour

Ambient outside = 112 nanosieverts per hour

Soil exposed to rain water = 108 nanosieverts per hour

Garlic from Central Market = 129 nanosieverts per hour

Tap water = 73 nanosieverts per hour

Filter water = 56 nanosieverts per hour

-

Nuclear News Roundup Jun 08, 2024

Estonian parliament passes nuclear resolution world-nuclear-news.org

Kazatomprom gets go-ahead for Inkai 3 pilot world-nuclear-news.org

North Korea estimated to possess up to 50 nuclear weapons: think tank rfa.org

Row as NATO chief hints at talks to increase availability of nuclear weapons theguardian.com

-

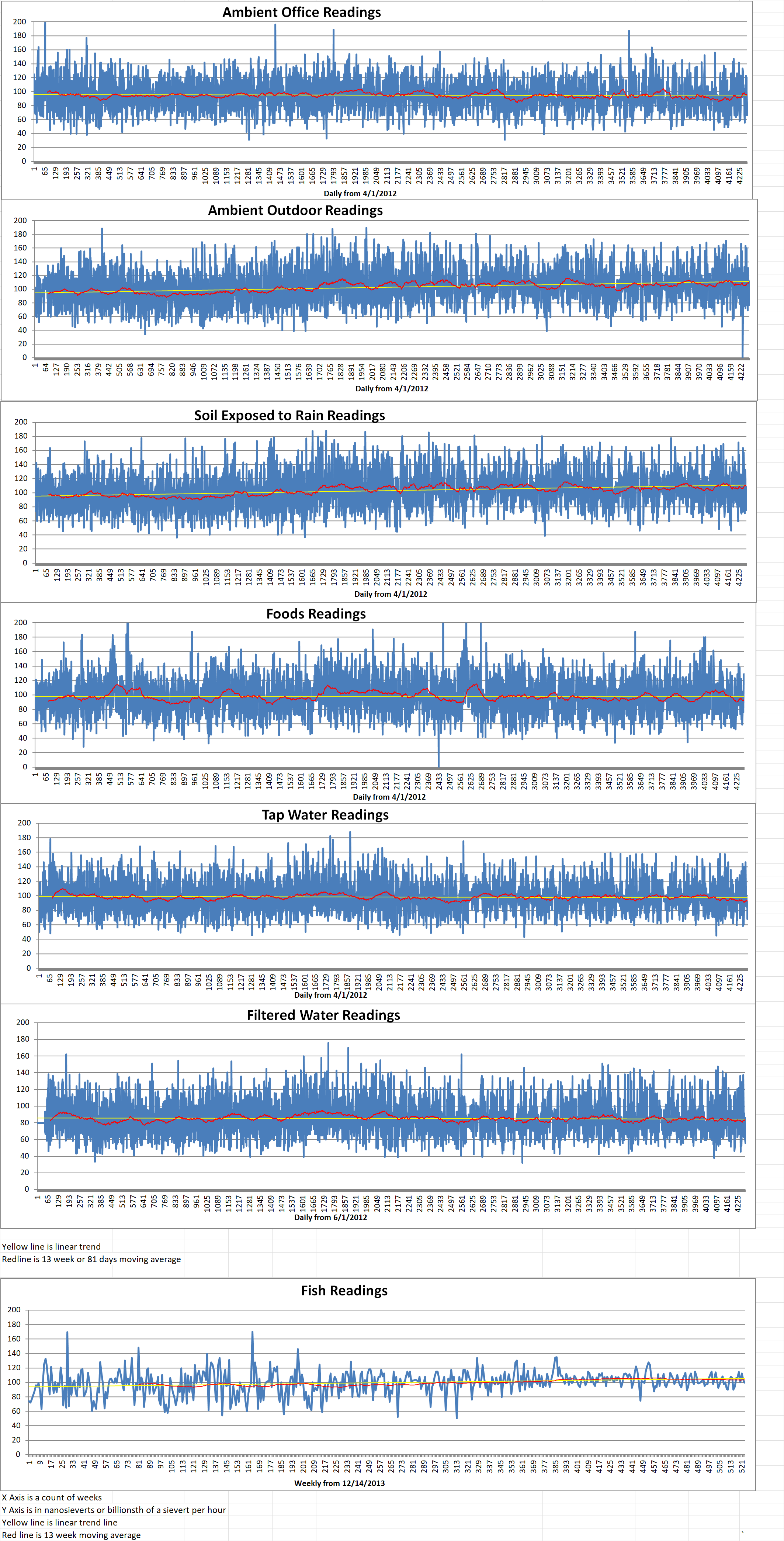

Geiger Readings for Jun 08, 2024

Ambient office = 66 nanosieverts per hour

Ambient outside = 96 nanosieverts per hour

Soil exposed to rain water = 97 nanosieverts per hour

Blueberry from Central Market = 115 nanosieverts per hour

Tap water = 68 nanosieverts per hour

Filter water = 60 nanosieverts per hour

Dover Sole from Central = 100 nanosieverts per hour