Part 2 of 4 Parts (Please read Part 1 first)

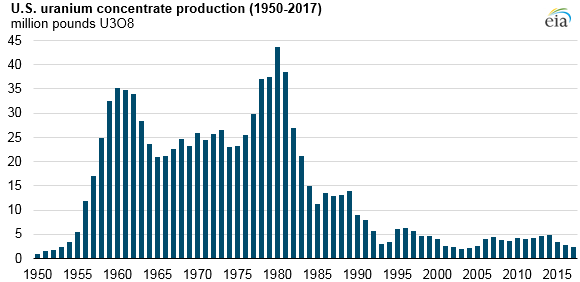

In addition to the competition from the Russian weapons grade ore in the 1990s, a wave of deregulation led to the development of a competitive power market in many parts of the country that would drive nuclear power out of the energy market. In the 1990s, the U.S. government privatized the Department of energy’s uranium enrichment operations. Forty-five thousand metric tons of uranium were transferred to the new private company that was created. In the early 2000s, U.S. uranium production reached its lowest level since the 1950s.

In the early 2000s, the nation of Kazakhstan, one of the old Soviet states, began developing uranium mining. In a few years, it became the biggest uranium producer in the world and the second biggest supplier of uranium to the U.S. market. Kazakhstan was able to increase production so rapidly by using something called “in situ leaching.”

Niger, Mali, Mongolia and Kazakhstan are all currently mining and selling uranium into the international market. They have very lax regulations which allow the in situ leaching mentioned above. It is a cheap method of separating uranium from ore. Toxic chemicals are pumped into uranium mines and uranium is processed from the run off of the leaching liquids. It can be very damaging to the environment and public health. A company spokesman for a uranium mining consultancy said, “Those are countries where their environmental institutions are very weak, their legislation is non-existent, so if you're competing with in situ leaching in essentially low-governance areas of the world it's going to be really, really hard.”

In the first years after the turn of the century, the prices for uranium rose. This was caused by declining stockpiles and the fact that interest in nuclear power was on the rise in the U.S. and in developing nations such as China and India. Energy Fuels and Ur-Energy were two private uranium companies that were started during this period. Both companies were started in Canada but they have uranium mines in the U.S. The CEO of Energy Fuels said “I would say at that time it was pretty frothy and in Canada particularly, there was just a lot of venture capital entering the uranium space for investment.”

In 2008, there was a global financial crisis that caused a reduction in the world-wide demand for electricity. During this same period, fracking technology was developed that resulted in a flood of cheap natural gas. This had an adverse impact on nuclear power plans. In addition to cheap natural gas, the rise in renewable energy sources such as solar and wind power made nuclear power even less competitive in the energy marketplace. In 2009, the Department of Energy began to sell excess uranium to pay for the cleanup of a federal uranium enrichment plant.

The nuclear disaster at Fukushima, Japan in March of 2011 caused a tremendous public rejection of nuclear power. Following the disaster, Japan shut down all of its nuclear power reactors. After eight years, they are just beginning to turn them back on. Germany decided to halt the use of nuclear power completely by 2022 and they have pursued the shutdown of their nuclear power reactors as planned in the intervening years.

Please read Part 3